Exploring Dividend Stocks: A Deep Dive into Snap-On (SNA)

Dividends are a cherished reward for investors who choose to become shareholders. They represent a portion of a company’s earnings distributed to its stockholders. However, finding a dividend stock that offers a robust yield, a solid financial foundation, and a promising future can be a challenging endeavor. In this blog post, we’ll analyze Snap-On Incorporated (SNA) to determine if it fits the bill.

Snap-On: An Overview

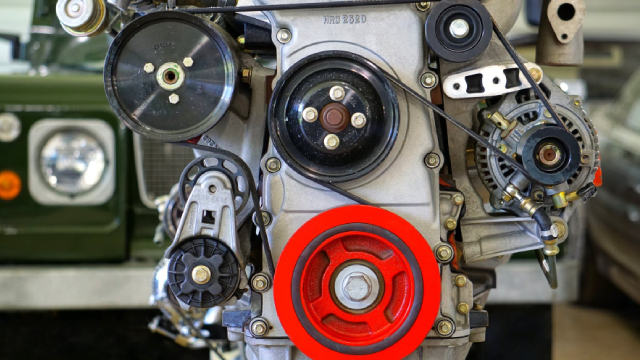

Snap-On Incorporated is a leading global innovator, manufacturer, and marketer of tools, equipment, diagnostics, repair information, and systems solutions for the automotive repair industry. The company’s products and services cater to both professional repair technicians and do-it-yourself consumers. With a rich history dating back to 1920, Snap-On has built a strong reputation for quality, innovation, and customer service.

Financial Performance and Dividend History

Snap-On’s financial performance has been consistent and stable over the years. The company has reported steady revenue growth, averaging around 2% to 3% annually, and a net income growth rate of approximately 5% to 6% year-over-year. This financial stability has enabled Snap-On to increase its dividend payments regularly, making it an attractive option for income-focused investors.

Snap-On’s dividend history is impressive. The company has paid dividends for the past 91 consecutive years, making it a member of the prestigious Dividend Aristocrats Index. The current dividend yield hovers around 2.4%, which is above the average yield for the S&P 500.

Future Prospects

Snap-On’s future prospects look promising. The global automotive repair market is expected to grow at a CAGR of 3.8% between 2021 and 2026. With Snap-On’s strong brand recognition, extensive product portfolio, and global presence, the company is well-positioned to capitalize on this growth.

Impact on Individuals and the World

For individuals, investing in Snap-On offers the potential for both capital appreciation and a steady income stream through dividends. As a shareholder, you’ll also benefit from the company’s commitment to innovation and customer satisfaction, which can lead to long-term value creation.

On a global scale, Snap-On’s success contributes to the growth and sustainability of the automotive repair industry. The company’s focus on providing high-quality tools and services helps ensure that vehicles are maintained properly, which in turn supports the safety and efficiency of transportation systems worldwide.

Conclusion

Snap-On Incorporated is a solid dividend stock option for income-focused investors. Its impressive financial performance, long-standing dividend history, and promising future prospects make it a compelling choice for those seeking both current income and potential capital appreciation. Additionally, Snap-On’s impact on the automotive repair industry and the world at large underscores the importance of investing in companies with a strong commitment to innovation and customer satisfaction.

- Snap-On Incorporated is a leading global provider of tools, equipment, diagnostics, repair information, and systems solutions for the automotive repair industry.

- The company has reported consistent revenue and net income growth and has paid dividends for the past 91 consecutive years.

- Snap-On’s future prospects are promising, with the global automotive repair market expected to grow at a CAGR of 3.8% between 2021 and 2026.

- Investing in Snap-On offers the potential for both current income through dividends and potential capital appreciation.

- Snap-On’s success contributes to the growth and sustainability of the automotive repair industry and the transportation systems worldwide.