Tesla’s Disappointing February: A Double Whammy for Elon Musk

February 2023 brought a significant double whammy for Tesla and its CEO, Elon Musk. The stock market witnessed a steep decline in Tesla shares, marking the company’s worst monthly performance since December 2022. Simultaneously, Musk began his tenure as a key advisor in President Donald Trump’s second term administration.

Tesla’s Plunging Shares

Tesla’s shares took a nosedive in February, shedding 28% of their value. This marked a substantial setback for the electric vehicle (EV) manufacturer, which had seen remarkable growth in recent years. The downturn in the stock price was attributed to several factors, including:

- Economic Uncertainties: The global economy faced numerous challenges, including inflation, rising interest rates, and geopolitical tensions, all of which negatively impacted investor sentiment towards Tesla and other tech stocks.

- Regulatory Scrutiny: Tesla encountered renewed regulatory scrutiny, with the Securities and Exchange Commission (SEC) reportedly investigating Musk’s tweets regarding Tesla’s stock price and production targets.

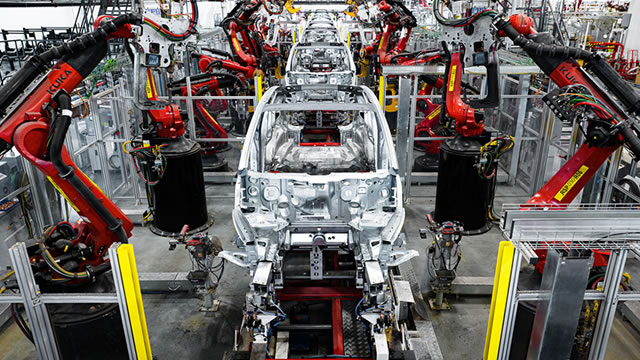

- Competition: The EV market became increasingly competitive, with new players entering the scene and established automakers ramping up their electric vehicle initiatives.

Elon Musk’s Role in the White House

In a surprising turn of events, Elon Musk joined President Donald Trump’s second term administration as a key advisor, starting in February 2023. Musk’s role was not officially announced, but reports indicated that he would focus on technological innovation and climate change. This appointment came amidst Tesla’s stock troubles and raised questions about the potential impact on the company.

Implications for Tesla and the World

The double whammy of Tesla’s disappointing February performance and Musk’s new role in the White House brought about several implications:

For Tesla: The stock downturn could lead to decreased investor confidence and potentially impact the company’s ability to raise capital for future projects. Musk’s time in the White House could also present distractions and potential conflicts of interest.

For the World: Tesla’s struggles may indicate larger issues within the EV market and the broader technology sector. Musk’s presence in the White House could potentially influence technological policies, both domestically and internationally.

Conclusion

February 2023 proved to be a challenging month for Tesla and its CEO, Elon Musk. The company experienced its worst monthly stock performance since December 2022, while Musk began his tenure as a key advisor in President Donald Trump’s second term administration. The implications of these events for Tesla and the world remain to be seen, but one thing is clear: the electric vehicle market and the broader technology sector face significant challenges in the months ahead.

As investors and observers, it is crucial to stay informed about these developments and their potential impact on the companies and industries we care about. By staying up-to-date on the latest news and trends, we can make informed decisions and navigate the ever-evolving business landscape.