Super Micro Computer: A Turnaround Story

Super Micro Computer, a leading innovator in high-performance, high-efficiency server technology and green computing, has seen a remarkable turnaround in its stock performance this year. The company’s shares have surged year-to-date, fueled by increased institutional ownership and renewed investor confidence.

Accounting Concerns Addressed

Earlier this year, Super Micro faced accounting irregularities that raised concerns among investors. However, the company swiftly addressed these issues. Super Micro filed its annual and quarterly reports on time, providing much-needed transparency. BDO USA, one of the world’s leading accounting and consulting firms, confirmed the financial statements’ accuracy, further reassuring the market.

Institutional Ownership on the Rise

The positive news did not go unnoticed by institutional investors. Institutional ownership in Super Micro has been on the rise, with big names like BlackRock and Vanguard increasing their stakes. This increased institutional backing not only provides Super Micro with financial resources but also lends credibility to the company.

Substantial Revenue Growth Ahead

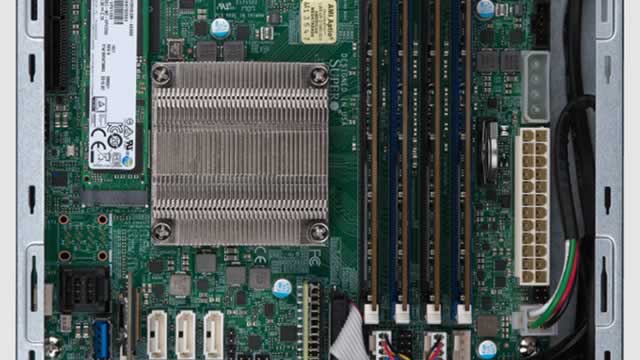

Super Micro’s financial recovery is not the only reason for optimism. The company is also well-positioned for substantial revenue growth in the coming years. Significant data center capital expenditures (capex) from major tech firms are expected to drive demand for Super Micro’s high-performance servers. Furthermore, Super Micro’s advanced Dynamic Liquid Cooling (DLC) technology is gaining traction in the market, offering energy savings and improved efficiency.

Impact on Individuals

For individual investors, Super Micro’s turnaround story presents an attractive opportunity. With renewed confidence from institutional investors, a solid financial footing, and promising growth prospects, Super Micro’s stock could be a strong addition to any portfolio. However, as with any investment, it’s essential to conduct thorough research and consider the risks involved.

Impact on the World

Super Micro’s success story extends beyond its shareholders. The company’s advanced server technology and green computing initiatives contribute to the broader tech industry and the world at large. Super Micro’s DLC technology, for instance, can help reduce the carbon footprint of data centers, contributing to a more sustainable digital future. Moreover, the company’s high-performance servers power many critical applications, from cloud services to scientific research, making a difference in people’s lives every day.

Conclusion

Super Micro Computer’s turnaround story is a testament to the power of transparency, innovation, and investor confidence. With renewed financial stability, institutional backing, and promising growth prospects, Super Micro is poised to make a significant impact on the tech industry and beyond. For individual investors and the world, this is an exciting time to be part of Super Micro’s journey.

- Super Micro’s stock has surged year-to-date, driven by increased institutional ownership and financial transparency.

- The company’s advanced DLC technology and high-performance servers position it for substantial revenue growth in the coming years.

- Individual investors can benefit from Super Micro’s turnaround story, but thorough research is essential.

- Super Micro’s success extends beyond its shareholders, contributing to a more sustainable digital future and powering critical applications.