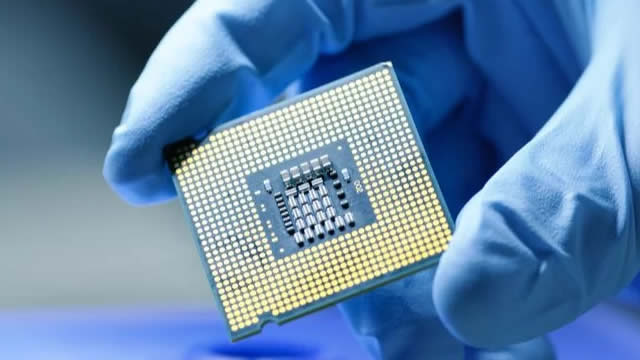

TSMC: The Uncontested Champion in Semiconductor Manufacturing

If you’re not a tech insider, you might not have heard of TSMC (Taiwan Semiconductor Manufacturing Company) yet, but trust us, this unassuming acronym is making waves in the world of technology. TSMC’s market position and growth prospects remain unparalleled, making it a must-know name for anyone keeping an eye on the tech industry.

Why TSMC Matters

TSMC is the world’s largest dedicated semiconductor foundry, producing chips for tech giants like Apple, AMD, and Qualcomm. The company’s advanced manufacturing processes give its clients an edge, enabling them to create smaller, faster, and more power-efficient chips. And with no real competition in sight, TSMC’s dominance in the industry is secure.

TSMC’s Arizona Fab: A Step Forward, a Step Back

TSMC’s latest move is the construction of a new state-of-the-art semiconductor fabrication plant in Arizona, USA. This new facility, known as Fab 18, is expected to mitigate geopolitical risks by diversifying TSMC’s manufacturing base beyond Taiwan. However, it may also reduce TSMC’s margins due to the higher labor costs in the US.

The Numbers Don’t Lie: TSMC’s Undervalued Stock

Despite its market dominance, TSMC’s stock is currently valued at a relatively low multiple of 26x. Analysts estimate that a fair value for TSMC would be around 30x, suggesting a potential upside of 93% by FY26. That’s a significant growth opportunity for investors!

What Does This Mean for You?

If you’re an investor, this means TSMC could be a wise addition to your portfolio. The company’s strong market position, advanced technology, and promising growth prospects make it an attractive investment opportunity. And if you’re a tech enthusiast, keep an eye on TSMC – the innovations it creates will likely find their way into the devices you use every day.

The Impact on the World

TSMC’s continued growth and innovation will have far-reaching effects on the world. New technologies like autonomous vehicles, artificial intelligence, and the Internet of Things will become more accessible as TSMC’s chips make them more efficient and affordable. Furthermore, the company’s expansion into the US could lead to new collaborations and partnerships, further fueling innovation and economic growth.

In Conclusion

TSMC’s market dominance, advanced technology, and promising growth prospects make it a force to be reckoned with in the tech industry. With the construction of its new fab in Arizona and its undervalued stock, TSMC is poised for significant growth, benefiting both investors and the world as a whole. So, keep an eye on this unassuming acronym – it’s making waves in the tech world, and you don’t want to miss out!

- TSMC is the world’s largest dedicated semiconductor foundry

- Advanced manufacturing processes give clients an edge

- No real competition in sight

- New Arizona fab to mitigate geopolitical risks, but may reduce margins

- TSMC’s stock currently valued at 26x, with a fair value estimate of 30x

- Significant growth opportunity for investors

- New technologies will become more accessible and affordable

- Expansion into the US could lead to new collaborations and partnerships