MercadoLibre (MELI): A Bright Future Ahead

The digital marketplace scene is witnessing an intriguing development as MercadoLibre (MELI) shares have started gaining traction. This Latin American e-commerce giant has been making waves in the investment world, and the trend seems set to continue in the near term.

Solid Earnings Estimate Revisions

The primary reason behind this optimistic outlook lies in the solid earnings estimate revisions. Analysts have been revising their earnings expectations for MELI upwards, indicating a growing confidence in the company’s financial performance. This upward trend in earnings estimates is a strong indicator of a potential stock price increase.

Financial Highlights

In the third quarter of 2021, MercadoLibre reported impressive financial results. The company’s revenue grew by 72% year over year, reaching $2.1 billion. Moreover, the net income came in at $249.3 million, a significant increase from the previous year’s $106.5 million. These numbers reflect the company’s ability to adapt to changing market conditions and capitalize on the growing e-commerce trend in Latin America.

Impact on Consumers

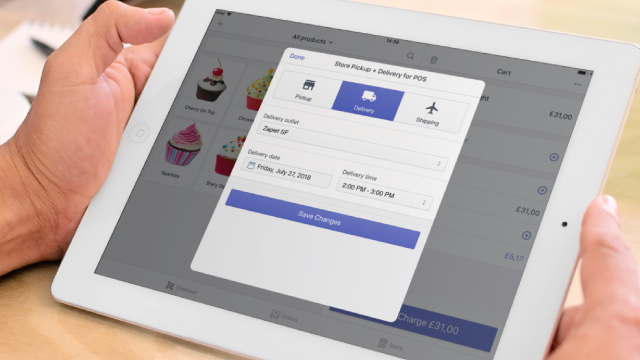

As MELI continues to thrive, consumers in Latin America stand to benefit from increased competition and innovation in the e-commerce space. With more players entering the market and existing ones improving their offerings, consumers can expect better prices, faster delivery times, and a wider selection of products. Moreover, the growing popularity of digital payments through MercadoPago, MELI’s payment solution, will make online shopping even more convenient for consumers in the region.

Global Implications

The success of MercadoLibre is not just limited to Latin America. It serves as a testament to the growing potential of e-commerce in emerging markets. As more consumers in these regions adopt digital shopping habits, companies like MELI will continue to expand and innovate, offering new opportunities for investors and fueling the global economic growth.

Investor Perspective

From an investor’s perspective, the solid earnings estimate revisions and impressive financial results make MELI an attractive investment option. The company’s strong market position, growing user base, and innovative offerings provide a solid foundation for future growth. Furthermore, the increasing trend of e-commerce adoption in Latin America and other emerging markets presents a significant long-term growth opportunity for MELI.

Conclusion

In conclusion, the recent surge in MercadoLibre’s stock price is not just a short-term trend. The company’s solid financial performance, impressive earnings estimate revisions, and growing market potential make it a strong investment option for the long term. Moreover, the impact of MELI’s success extends beyond its Latin American user base, offering significant opportunities for both consumers and investors in the global e-commerce landscape.

- MercadoLibre reports impressive financial results

- Analysts revise earnings estimates upwards

- Consumers in Latin America to benefit from increased competition and innovation

- Global implications: Growing potential of e-commerce in emerging markets

- Investors: Attractive long-term investment opportunity