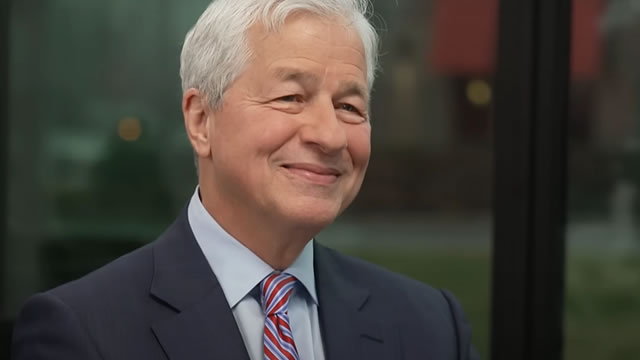

Exploring the Future of JPMorgan Chase & Co. (JPM)

JPMorgan Chase & Co. (JPM) has been a stock of significant interest to Zacks.com users in recent times. With its robust financial performance and industry-leading position, it’s no wonder that investors keep a close eye on this banking giant. In this post, we’ll delve deeper into what the future may hold for JPMorgan Chase.

Financial Performance

JPMorgan Chase has consistently delivered strong financial results. In the third quarter of 2021, the company reported earnings per share (EPS) of $3.02, exceeding analysts’ estimates by $0.41. The bank’s net income came in at $10.6 billion, a 54% year-over-year increase. These impressive numbers can be attributed to the bank’s diverse revenue streams, including its investment banking, commercial banking, and consumer businesses.

Regulatory Environment

One factor that could impact JPMorgan Chase’s future is the regulatory environment. The bank has faced increased scrutiny in recent years due to various scandals and the larger role of banks in the economy. However, the Biden administration’s focus on infrastructure spending and economic recovery could lead to more favorable conditions for the banking industry. Additionally, the Federal Reserve’s decision to maintain its accommodative monetary policy could help support JPMorgan Chase’s earnings growth.

Technology and Innovation

Another area of focus for JPMorgan Chase is technology and innovation. The bank has been investing heavily in digital initiatives, such as its digital-only banking brand, Chase Secure Banking, and its artificial intelligence (AI) platform, COIN. These investments could help JPMorgan Chase stay competitive in an increasingly digital world and potentially lead to new revenue streams. However, there are also risks associated with these investments, such as cybersecurity threats and the need to adapt to changing regulations.

Impact on Individuals

For individual investors, the future of JPMorgan Chase could mean potential gains if the stock continues to perform well. However, there are also risks to consider, such as market volatility and regulatory changes. It’s important for investors to stay informed about the company’s financial performance and any potential regulatory developments. Additionally, those who use JPMorgan Chase’s products and services should keep an eye on how the company’s digital initiatives may impact their experience.

Impact on the World

On a larger scale, the future of JPMorgan Chase could have implications for the global economy. As one of the largest banks in the world, JPMorgan Chase plays a significant role in the financial system. Its financial performance and regulatory environment could impact other financial institutions and the overall health of the economy. Additionally, the bank’s investments in technology and innovation could lead to new financial products and services that could change the way we manage our money.

Conclusion

In conclusion, the future of JPMorgan Chase is an intriguing topic for investors and observers alike. With its strong financial performance, focus on technology and innovation, and regulatory environment, there are both opportunities and risks for the bank. For individuals, staying informed about JPMorgan Chase’s financial performance and regulatory developments is crucial. On a larger scale, the bank’s impact on the global economy could be significant, making it an important topic to watch.

- JPMorgan Chase has reported strong financial results in recent quarters

- Regulatory environment and technology investments are key factors to watch

- Individuals should stay informed about the company’s financial performance and regulatory developments

- JPMorgan Chase’s impact on the global economy is significant