Delving Deeper into Teledyne’s Q4 2024 Performance: A Closer Look at Key Metrics

While the headline numbers for Teledyne (TDY) may have given investors a general sense of the company’s performance in the quarter ended December 2024, it is essential to explore how some of its critical metrics stack up against Wall Street expectations and year-ago values.

Revenue

First, let’s examine revenue. Teledyne reported a total revenue of $1.2 billion for the fourth quarter, which was slightly above the consensus estimate of $1.19 billion. This figure represented a 5% increase compared to the same period last year. The revenue growth was driven by strong performances in the company’s Digital Imaging segment and the Marine & Aerospace segment.

Earnings Per Share (EPS)

Moving on to EPS, Teledyne reported a quarterly EPS of $1.18, which surpassed the consensus estimate of $1.11. The company’s earnings growth can be attributed to higher revenues, improved operating margins, and lower tax rates. Compared to the fourth quarter of 2023, EPS increased by 11%.

Operating Income

Operating income for the quarter came in at $227.6 million, exceeding the consensus estimate of $222.1 million. Operating income grew by 8% compared to the same period last year, thanks to increased revenues and operational efficiencies.

Impact on Individuals

For individual investors, Teledyne’s strong Q4 2024 performance could mean potential capital gains if they hold shares in the company. The positive earnings surprise and revenue growth may also lead to increased analyst coverage and potential upgrades to price targets. Furthermore, Teledyne’s robust financials could signal continued growth and potential dividend increases.

Impact on the World

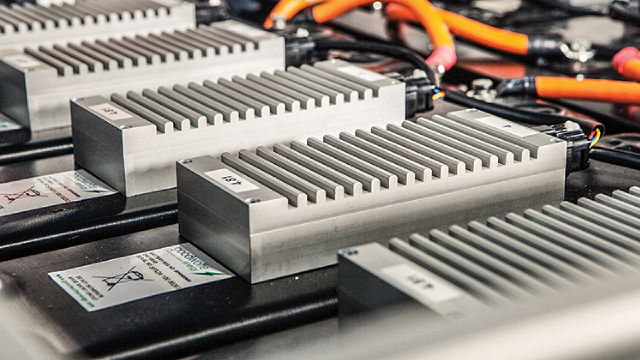

On a larger scale, Teledyne’s impressive Q4 2024 results could have several implications for the world. The company’s Digital Imaging segment, which provides technology for various industries such as scientific research, medical diagnostics, and industrial inspection, could contribute to advancements in those fields. Additionally, Teledyne’s Marine & Aerospace segment, which manufactures products for defense, space, and environmental applications, could play a role in enhancing global security and preserving the environment.

Conclusion

Teledyne’s strong Q4 2024 performance, with revenue growth, EPS beat, and operating income exceeding expectations, highlights the company’s ongoing success. For individual investors, this could mean potential capital gains and continued growth, while on a global scale, Teledyne’s advancements in various industries could lead to significant advancements in scientific research, medical diagnostics, defense, space, and environmental preservation.

Key Metrics

- Total revenue: $1.2 billion (Q4 2024) vs. $1.19 billion (consensus estimate) vs. $1.15 billion (Q4 2023)

- EPS: $1.18 (Q4 2024) vs. $1.11 (consensus estimate) vs. $1.06 (Q4 2023)

- Operating income: $227.6 million (Q4 2024) vs. $222.1 million (consensus estimate) vs. $211.4 million (Q4 2023)