Salesforce Inc. CRM Shares Plummet in Early Trading After Q4 Results

In an unexpected turn of events, Salesforce Inc. (CRM) shares experienced a significant decline in early trading on Thursday, following the release of the company’s fourth-quarter financial results. The stock dropped by more than 6%, causing ripples in the tech industry.

Financial Performance

The downturn came after Salesforce reported lower-than-expected earnings for the quarter, with revenue growing at a slower rate than anticipated. The company’s earnings per share came in at $0.83, missing analysts’ estimates by $0.02. Additionally, Salesforce’s revenue for the quarter grew by 20%, which was below the projected 21% growth rate.

Causes for Concern

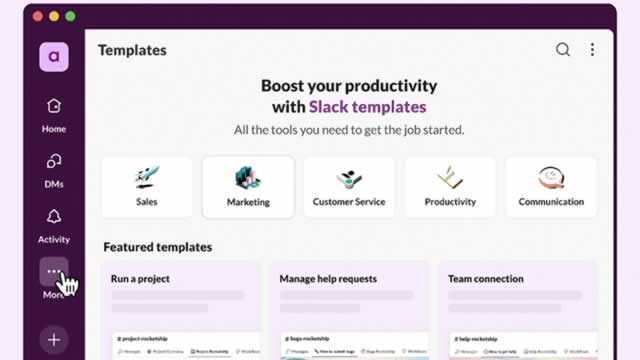

Several factors may have contributed to Salesforce’s disappointing results. One potential cause is the ongoing economic uncertainty, which has led to cautious spending by businesses. Another factor is increased competition in the CRM market, with competitors like Microsoft Dynamics and Oracle offering similar services at lower prices. Moreover, Salesforce’s acquisition of Slack Technologies in July 2020 for $27.7 billion may also be a concern for investors, as the integration of the two companies could be more complex and time-consuming than anticipated.

Impact on Individual Investors

For individual investors who hold Salesforce shares, the decline in stock price could lead to significant losses. Those who have a long-term investment strategy may choose to hold on to their shares, as Salesforce remains a dominant player in the CRM market and has a strong brand reputation. However, short-term investors may choose to sell their shares to minimize their losses.

Impact on the Tech Industry and Economy

The decline in Salesforce’s stock price could have wider implications for the tech industry and the economy as a whole. Salesforce is a leading player in the CRM market and its performance can serve as an indicator of market trends and investor sentiment towards technology companies. Moreover, Salesforce’s acquisition of Slack could signal a trend towards consolidation in the tech industry, with larger companies acquiring smaller rivals to expand their offerings and gain a competitive edge.

Market Reaction

The tech sector was broadly affected by Salesforce’s disappointing results, with other tech stocks experiencing similar declines. The NASDAQ Composite Index and the S&P 500 Index both saw declines of more than 1% on the day of the announcement. However, it is important to note that one company’s results do not necessarily indicate a wider economic trend.

Looking Ahead

Looking ahead, Salesforce is expected to continue investing in its product offerings and expanding its customer base. The company has announced several new initiatives, including the launch of its new Customer 360 platform and the expansion of its partnership with Amazon Web Services. However, these initiatives may come at a cost, and investors will be watching closely to see if they translate into increased revenue and profitability.

- Salesforce Inc. reported lower-than-expected earnings and revenue growth for Q4 2020

- Stock price dropped by more than 6% in early trading on Thursday

- Several factors contributed to the disappointing results, including economic uncertainty and increased competition

- Impact on individual investors depends on their investment strategy

- Wider implications for the tech industry and economy

In conclusion, Salesforce Inc.’s disappointing fourth-quarter results led to a significant decline in its stock price, causing ripples in the tech industry and beyond. While the causes for the decline are multifaceted, investors and analysts will be closely watching the company’s future initiatives to see if they translate into increased revenue and profitability. For individual investors, the impact depends on their investment strategy, while the wider implications for the tech industry and economy remain to be seen.

It is important to remember that one company’s results do not necessarily indicate a wider economic trend, and investors should consider the broader market conditions and industry trends when making investment decisions. Salesforce remains a dominant player in the CRM market and has a strong brand reputation, but the integration of Slack and the company’s ongoing investments may come at a cost. As always, it is important to do your own research and consult with a financial advisor before making any investment decisions.