The Exciting Rebound of High-yielding Texas Instruments (TXN) in 2025

If you’ve been keeping an eye on the stock market, you might have noticed the slight wobble in the graph of Texas Instruments (TXN) in 2024. But fear not, fellow investors! This tech titan is not going down without a fight. In fact, according to our analysis, TXN is gearing up for a strong rebound in 2025.

A Brief Hiccup in Growth

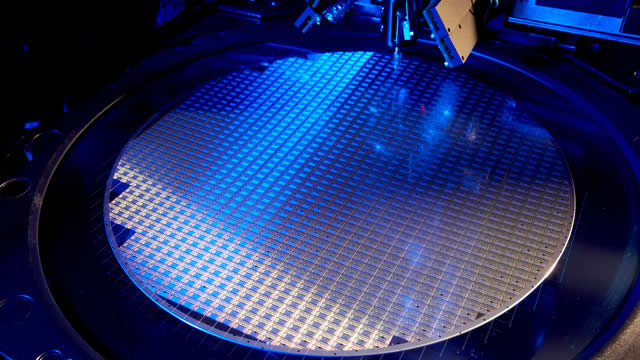

First, let’s talk about what happened in 2024. Texas Instruments, a leading semiconductor company, experienced a slight contraction in its business. This was largely due to the global economic downturn and the semiconductor industry’s cyclical nature. But don’t be disheartened! A closer look at the numbers reveals that this contraction was a mere blip.

Reverting to Growth

As we move into 2025, the situation is looking up for Texas Instruments. The company’s revenue is expected to rebound, fueled by increasing demand for semiconductors in various industries, such as automotive, industrial, and consumer electronics.

A Robust Long-term Outlook

But that’s not all! The long-term outlook for Texas Instruments is nothing short of robust. The global semiconductor market is projected to grow at a CAGR of 8.5% between 2022 and 2028, and Texas Instruments is well-positioned to capitalize on this growth. The company’s focus on innovation, its strong financial position, and its diverse product portfolio make it a formidable player in the semiconductor industry.

What Does This Mean for Me?

Now, you might be wondering, “What does all this mean for me as an investor?” Well, if you’ve been holding onto your TXN stocks, hanging on tight through the ups and downs, you’re in luck! The rebound in 2025 could mean significant gains for your investment. And if you’ve been considering investing in TXN, now might be the perfect time to take the plunge.

A Global Impact

But the impact of Texas Instruments’ rebound doesn’t stop at individual investors. The company’s strong performance will also have a ripple effect on the global economy. As Texas Instruments continues to innovate and grow, it will contribute to the advancement of various industries, from automotive to healthcare, creating new jobs and driving economic growth.

Conclusion

So there you have it, folks! The slight contraction in Texas Instruments’ business in 2024 was just a temporary hiccup, and the company is poised for a strong rebound in 2025. As an investor, this means potential gains for your portfolio. And on a larger scale, Texas Instruments’ growth will contribute to the advancement of various industries and the global economy as a whole. So hold onto your hats, and let’s ride the wave of innovation and growth together!

- Texas Instruments is a leading semiconductor company.

- The company experienced a slight contraction in 2024 due to the global economic downturn and the semiconductor industry’s cyclical nature.

- The company’s revenue is expected to rebound in 2025, fueled by increasing demand for semiconductors in various industries.

- The long-term outlook for Texas Instruments is robust, with the global semiconductor market projected to grow at a CAGR of 8.5% between 2022 and 2028.

- The company’s strong performance will have a ripple effect on the global economy, contributing to the advancement of various industries and driving economic growth.