Nvidia’s Enduring Significance in AI Amidst Competition

Nvidia, a leading technology company, continues to hold a crucial position in the realm of Artificial Intelligence (AI) development, despite the emergence of cost-efficient models like DeepSeek’s R1. This assertion is not based on mere speculation but on a thorough analysis of market trends, growth prospects, and geopolitical factors.

Market Fear and Buying Opportunities

The current market fear surrounding Nvidia’s stock is largely driven by concerns over intense competition and potential regulatory hurdles. However, a closer look at the numbers reveals that these fears might be overblown. According to a comprehensive analysis, Nvidia boasts a base-case upside of 87.5% in the next 12 months, offering a significant buying opportunity for investors.

Growth Prospects

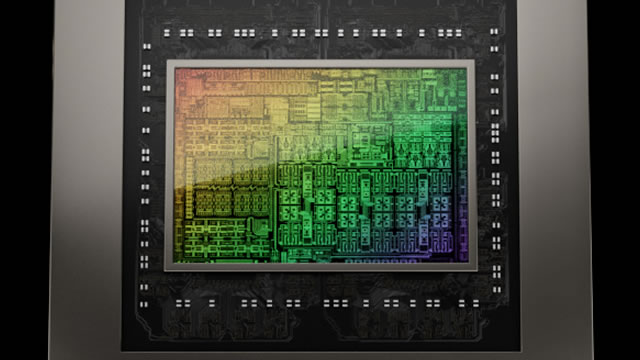

Nvidia’s growth prospects are underpinned by its strong presence in the gaming industry and its pivotal role in the development of AI technologies. The company’s graphics processing units (GPUs) are the backbone of modern gaming, and its data center segment is expected to grow as AI adoption becomes more widespread. Furthermore, the company’s focus on research and development ensures that it stays at the forefront of technological advancements.

Geopolitical Factors

While competition from Chinese AI innovations is a concern, diplomatic tension between the U.S. and China poses a greater long-term risk to Nvidia. The ongoing tension over Taiwan, in particular, could lead to trade restrictions and supply chain disruptions. However, it is essential to note that the company has a diverse customer base and operates in various regions around the world, mitigating the impact of any potential disruptions.

Impact on Individuals

For individuals interested in investing, Nvidia’s strong growth prospects and undervalued stock price present an attractive opportunity. However, it is crucial to consider the risks involved and maintain a diversified investment portfolio. Additionally, the advancements in AI technology could lead to new job opportunities in areas such as data analysis, machine learning, and software development.

Impact on the World

Nvidia’s continued dominance in AI has far-reaching implications for the world. The company’s GPUs are used in various applications, from gaming and scientific research to autonomous vehicles and healthcare. Moreover, the advancements in AI technology could lead to significant improvements in various industries, from manufacturing and transportation to education and healthcare.

Price Target and Earnings Growth

Based on a fair P/E multiple of 50-56, my price target for Nvidia’s stock in January 2026 ranges from $222 to $248.50. This target is supported by a projected EPS CAGR of 75%. Given the current stock price of $118.50, this represents significant upside for investors.

Conclusion

Despite the emergence of cost-efficient AI models and geopolitical tensions, Nvidia remains a critical player in the AI landscape. Its strong growth prospects, diverse customer base, and focus on innovation make it an attractive investment opportunity. Moreover, the advancements in AI technology could lead to significant improvements in various industries and create new job opportunities. As always, it is essential to consider the risks involved and maintain a diversified investment portfolio.

- Nvidia’s strong presence in the gaming industry and AI development

- Company’s focus on research and development

- Diverse customer base and global operations

- Significant upside potential for investors

- Advancements in AI technology could lead to new job opportunities and improvements in various industries