NRG Energy Surpasses Wall Street Estimates in Q4, Unveils Plans for Data Center Expansion

NRG Energy Inc. reported fourth-quarter earnings on Wednesday that surpassed analysts’ expectations, driven by increased power demand and reduced fuel costs. The energy company’s adjusted profit came in at $0.32 per share, exceeding the consensus estimate of $0.25 per share. Total revenue for the quarter was $3.2 billion, up from $2.9 billion in the same period last year.

Strong Demand for Power

NRG Energy attributed the higher profits to the increased demand for power in the electric grid, which was driven by colder weather in the eastern United States and California. The company’s wholesale power segment reported a 12% increase in revenue compared to the previous year, while its retail segment saw a 4% growth.

Lower Fuel Costs

Lower fuel costs also contributed to NRG Energy’s improved financial performance in the fourth quarter. The company reported a decrease in fuel costs by $141 million compared to the same period last year, largely due to lower natural gas prices. NRG Energy’s natural gas-fired power plants generated 56% of the company’s total electricity output in 2020, making fuel costs a significant expense.

Data Center Expansion

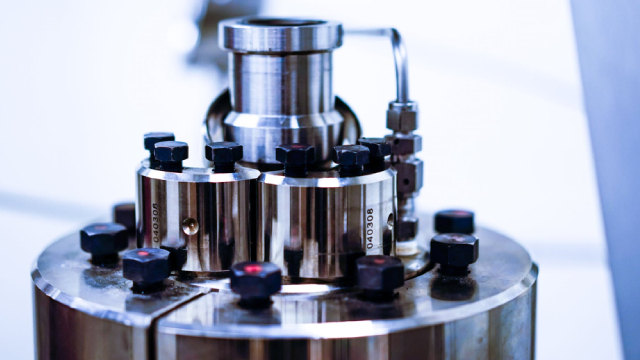

In addition to reporting its financial results, NRG Energy also announced its plans to capitalize on the growing demand from data centers. The company will invest $1 billion over the next five years to build and operate data centers that will be powered by renewable energy. NRG Energy aims to provide data center customers with a reliable and sustainable energy source, while also reducing their carbon footprint.

Impact on Consumers

For consumers, NRG Energy’s strong financial performance and expansion into the data center market could lead to increased competition and potentially lower electricity rates. As more companies invest in renewable energy and data centers, the market may become more saturated, leading to price pressures. However, this could also result in higher demand for electricity, which could push prices up.

Impact on the World

On a larger scale, NRG Energy’s expansion into the data center market is a sign of the growing importance of renewable energy in the technology sector. Data centers consume a significant amount of electricity, making it important for them to find sustainable energy sources. As more companies follow NRG Energy’s lead and invest in renewable energy, it could help reduce the carbon footprint of the tech industry and contribute to the global effort to combat climate change.

- NRG Energy reported stronger-than-expected fourth-quarter earnings, driven by increased power demand and lower fuel costs.

- The company’s adjusted profit came in at $0.32 per share, exceeding the consensus estimate of $0.25 per share.

- NRG Energy plans to invest $1 billion over the next five years to build and operate data centers powered by renewable energy.

- The company’s expansion into the data center market could lead to increased competition and potentially lower electricity rates for consumers.

- The growing importance of renewable energy in the technology sector could help reduce the carbon footprint of the tech industry and contribute to global efforts to combat climate change.

Conclusion

NRG Energy’s strong fourth-quarter performance and expansion into the data center market are positive signs for the energy industry and the tech sector. The company’s ability to capitalize on increased power demand and lower fuel costs demonstrates its financial strength, while its investment in renewable energy for data centers shows its commitment to sustainability. As more companies follow suit, the impact on consumers and the world could be significant, from potentially lower electricity rates to a reduced carbon footprint for the tech industry.