Marathon Petroleum: A Tale of Two Missing Ingredients

Marathon Petroleum Corporation (MPC), a leading independent refiner, transporter, and marketer of petroleum products, is gearing up to release its quarterly earnings report. However, the stars may not align in its favor for an earnings beat this time around. Let’s delve into the reasons why.

Two Crucial Ingredients: Refining Margins and Demand

Two essential components significantly impact a refining company’s ability to surpass earnings estimates – refining margins and demand. Marathon Petroleum has been grappling with both these elements.

Refining Margins: Not Quite Cooking

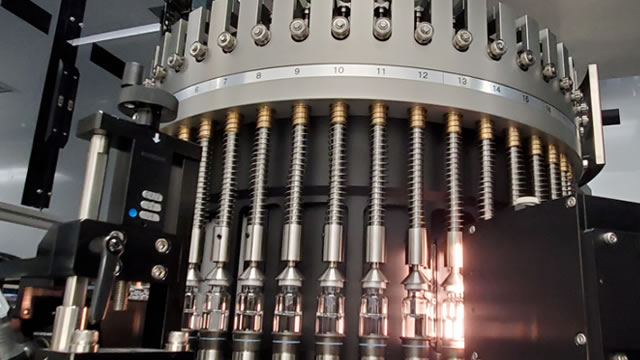

Refining margins represent the difference between the price of crude oil and the price of refined products like gasoline and diesel. When refining margins are high, it means that refineries are making a good profit. Unfortunately, Marathon Petroleum’s refining margins have been under pressure due to a few factors:

- Lower crude oil prices:

- Excess refining capacity:

- Weaker demand for gasoline and diesel

These factors have been squeezing refining margins, making it challenging for Marathon Petroleum to generate significant profits.

Demand: A Mixed Picture

Demand is the other critical ingredient for a strong earnings report. Marathon Petroleum has seen a mixed demand picture in recent quarters. While the demand for jet fuel has rebounded due to the travel industry’s recovery, gasoline and diesel demand have been sluggish. This uneven demand scenario has added to the company’s earnings woes.

What Does It Mean for Me?

If you’re an investor in Marathon Petroleum, you might want to brace yourself for potentially lower-than-expected earnings. This could lead to a potential stock price decline. However, it’s essential to remember that earnings reports are just one piece of the investment puzzle. Long-term fundamentals, such as the company’s competitive position and growth prospects, should also be considered.

What Does It Mean for the World?

On a larger scale, Marathon Petroleum’s earnings miss could have broader implications. A lackluster earnings report from a major refiner could signal ongoing challenges in the refining industry, including weak refining margins and demand fluctuations. This could potentially impact other refining companies and the overall energy sector.

Conclusion: A Cautious Outlook

As Marathon Petroleum prepares to release its earnings report, the odds of a beat seem slim due to the missing ingredients of strong refining margins and consistent demand. Investors should keep a watchful eye on the report and the company’s future guidance. Meanwhile, the world waits to see how this earnings miss could impact the refining industry and the energy sector as a whole.

Stay tuned for further insights as we continue to monitor the situation.