Discovering Cemtrex: A Neutral Rating from Zacks and Its Implications

Cemtrex, Inc. (CETX), a technology company specializing in products and services for the legal, lifestyle, and industrial markets, recently caught the attention of Wall Street with Zacks being the first to initiate coverage on the stock. The financial analysis firm assigned a “Neutral” rating to Cemtrex, sparking curiosity among investors about the company’s potential growth prospects and financial health.

Promising Growth Prospects

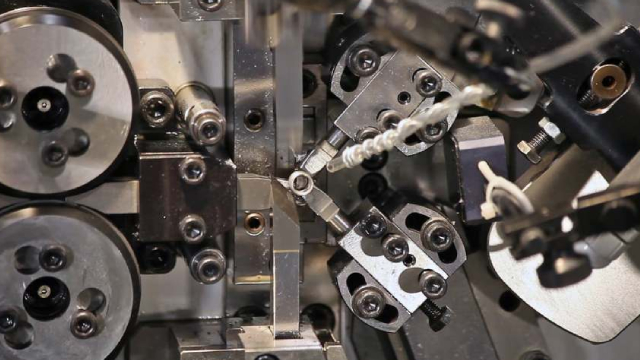

Cemtrex has been making strides in various industries, with its most notable accomplishments coming from its industrial division. The company’s SmartSolutions and MobiliZe divisions have been gaining traction, particularly in the areas of Internet of Things (IoT) and automation. The demand for smart technologies continues to grow, making Cemtrex’s offerings increasingly valuable to businesses looking to streamline their operations and enhance their customer experiences.

Moreover, Cemtrex’s recent acquisition of Intellicheck Mobility Systems, a leading provider of secure identity authentication and verification solutions, is expected to bolster the company’s growth. The acquisition adds a new revenue stream and expands Cemtrex’s presence in the rapidly growing identity verification market.

Financial Health Amid Market Challenges

Despite the promising growth prospects, Cemtrex faces challenges in the current market climate. The company reported a net loss in its most recent quarterly earnings report, which may have contributed to Zacks’ neutral rating. However, it’s essential to note that the loss was primarily due to one-time charges related to the acquisition of Intellicheck.

Looking at the company’s financials, Cemtrex’s revenue has been on a steady upward trend, growing from $7.5 million in Q1 2020 to $11.1 million in Q3 2020. The company’s gross profit margin also saw a slight improvement during this period. These figures suggest that Cemtrex is making progress in its efforts to boost revenue and improve its financial performance.

Impact on Individuals

For individual investors, Cemtrex’s “Neutral” rating from Zacks doesn’t necessarily mean that the stock is a bad investment. The rating indicates that the company’s growth prospects and valuation are roughly in line with the industry average. However, it’s essential to conduct thorough research and consider your personal investment goals and risk tolerance before making a decision.

Impact on the World

On a larger scale, Cemtrex’s developments in IoT and automation could have significant implications for businesses and industries worldwide. As more companies adopt smart technologies to streamline their operations and enhance customer experiences, the demand for Cemtrex’s products and services is likely to increase. Additionally, the acquisition of Intellicheck could lead to advancements in identity verification and security, potentially shaping the future of various industries, including finance, healthcare, and transportation.

Conclusion

Cemtrex’s “Neutral” rating from Zacks is a reflection of the company’s current financial position and growth prospects. However, the rating doesn’t tell the whole story. Cemtrex’s promising developments in IoT, automation, and identity verification have the potential to significantly impact businesses and industries worldwide. As an individual investor, it’s crucial to conduct thorough research and consider your personal investment goals and risk tolerance before making a decision on CETX. The company’s growth trajectory and financial health are worth keeping an eye on as it continues to innovate and expand its offerings.

- Cemtrex’s growth prospects in IoT and automation

- Impact of the acquisition of Intellicheck

- Individual investment considerations

- Potential implications for businesses and industries