Super Micro’s Precarious Position: A Tale of Unfiled Financial Reports and Nasdaq’s Deadline

In the bustling world of technology, where companies strive to innovate and grow, there are times when even the most established players face unexpected challenges. One such company currently finding itself in a precarious position is Super Micro Computer Inc. (SMCI).

The Looming Deadline

On Tuesday, shares of Super Micro plummeted as much as 10% during trading. The cause? The company is nearing a deadline to file its audited financial reports with the Nasdaq stock exchange. If Super Micro fails to meet this deadline, set for February 25, it risks being delisted from the exchange.

A Confident CEO

Earlier in the month, Super Micro’s CEO, Charles Liang, addressed investors’ concerns, expressing his confidence that the company would file those reports by the February 25 deadline. However, as the deadline approaches, uncertainty remains.

Impact on Investors

The potential delisting of Super Micro from the Nasdaq exchange has left investors feeling uneasy. The uncertainty surrounding the company’s financial reports has led to a significant decline in stock value. For those who have invested in Super Micro, this news could mean potential losses.

Global Implications

While the immediate impact of Super Micro’s financial report delay may be felt most acutely by its investors, the ripple effects can extend far beyond. Super Micro is a significant player in the technology industry, and its financial instability could have broader implications. For example:

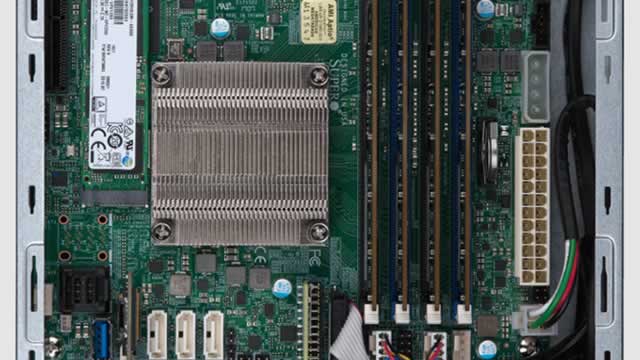

- Supply Chain Disruptions: Super Micro is a major supplier of server motherboards and systems. Any significant disruption to its operations could impact the technology sector as a whole.

- Market Volatility: The uncertainty surrounding Super Micro’s financial situation could lead to increased volatility in the technology sector.

- Investor Confidence: The delisting of Super Micro from the Nasdaq exchange could shake investor confidence in other technology companies, particularly those with financial reporting issues.

Looking Ahead

As the deadline approaches, the eyes of the business world will be on Super Micro. Will it file its financial reports on time, or will it join the ranks of delisted companies? Only time will tell. In the meantime, investors and industry experts will be closely monitoring the situation.

Conclusion

Super Micro’s financial report delay and potential delisting from the Nasdaq exchange serves as a reminder of the risks inherent in the business world. While the technology sector continues to innovate and grow, companies must maintain transparency and financial stability to thrive. As investors, it is essential to stay informed and make informed decisions based on accurate and timely information.

As the situation unfolds, we will continue to provide updates on this developing story. Stay tuned for more insights and analysis.