Nvidia Corporation: A BUY Amidst Market Volatility

Despite a recent stock drop, Nvidia Corporation (NVDA) remains a compelling investment opportunity. The cause of the stock decline was the entry of a new AI technology, DeepSeek, into the market. However, several factors make Nvidia an attractive buy:

Market Leadership

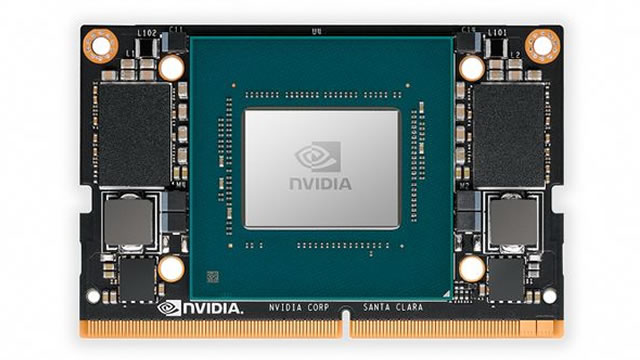

Nvidia’s market leadership in the AI sector is uncontested. Its GPUs (Graphics Processing Units) are the gold standard for AI applications. They offer superior performance, making them the preferred choice for major tech companies like Microsoft, Amazon, and Alphabet. These industry giants use Nvidia GPUs to power their data centers and AI projects.

Unique Ecosystem

Nvidia’s unique ecosystem is another strength. The company offers a comprehensive platform for AI development and deployment, including GPUs, software development tools, and cloud services. This ecosystem attracts a large and loyal customer base. Moreover, it provides a steady stream of revenue from both hardware and software sales.

Diversification and Robust Growth Prospects

Nvidia’s diversification into gaming, automotive, and edge computing markets has further strengthened its position. The gaming market provides a stable revenue base, while the automotive and edge computing markets offer significant growth opportunities. Nvidia’s evolution into a hardware-plus-software company also ensures robust growth prospects.

Impact on Consumers

For consumers, the entry of DeepSeek into the market may lead to increased competition and potentially lower prices for AI hardware. However, Nvidia’s market leadership and unique ecosystem position it well to maintain its market share. Moreover, the growing demand for AI-driven technologies in various industries will continue to fuel the growth of the market and benefit consumers through improved products and services.

Impact on the World

The impact of Nvidia’s continued growth on the world is significant. The company’s AI technologies are driving innovation in various industries, from healthcare and finance to transportation and manufacturing. They are helping to solve complex problems, improve efficiency, and create new business opportunities. Moreover, the increasing adoption of AI technologies is expected to lead to significant economic growth and job creation.

Conclusion

In conclusion, Nvidia Corporation remains a strong investment opportunity despite the recent stock drop. Its market leadership, unique ecosystem, and constant demand for AI-driven technologies ensure robust growth prospects. While the entry of new competitors like DeepSeek may lead to increased competition, Nvidia’s strengths position it well to maintain its market share. The growing demand for AI technologies will benefit consumers and the world at large through improved products and services, increased efficiency, and new business opportunities.

- Nvidia’s market leadership in the AI sector

- Unique ecosystem offering hardware, software, and cloud services

- Diversification into gaming, automotive, and edge computing markets

- Potential for increased competition and lower prices

- Significant economic growth and job creation through AI technologies