The Dramatic Plunge of Tesla’s Shares: A Monday Morning Surprise

As the clock struck 9:30 a.m. on a chilly Monday morning, the financial world held its collective breath. The previous week had seen Tesla’s (TSLA) shares reach an all-time closing high of almost $480 each, on December 17. But now, as the market opened, those shares were down almost 30%. An ominous sign for investors and an intriguing development for the rest of us.

A Shocking Reversal for Tesla Investors

The sudden drop in Tesla’s stock price took many investors by surprise. Some had ridden the wave of optimism and bought in at the peak, only to see their investments plummet in value in a matter of days. Others, who had been holding onto their Tesla shares for months or even years, were left wondering what had caused this unexpected reversal.

Understanding the Causes

There were several factors that contributed to Tesla’s stock price decline. One was the announcement of a new SEC investigation into Tesla’s CEO, Elon Musk, regarding a tweet he made about taking Tesla private at $420 per share. This tweet, which turned out to be unfounded, had initially sent Tesla’s stock price soaring, but when it became clear that the deal was not going to happen, the stock price plummeted.

Another factor was the overall market volatility. The stock market had been on a rollercoaster ride in recent weeks, with the S&P 500 seeing its biggest one-day drop in six months just a few days prior. This market instability, combined with the uncertainty surrounding Tesla’s leadership, led to a sell-off of Tesla shares.

The Impact on Tesla and the World

For Tesla, the stock price decline meant a loss of market capitalization, with the company’s value dropping by over $15 billion in a single day. This was a significant blow, but it was not fatal. Tesla still has a strong balance sheet and a dedicated customer base. However, the decline in stock price could make it more difficult for Tesla to raise capital in the future, as investors may be less willing to invest in a company with a volatile stock price.

For the rest of us, the Tesla stock price decline is a reminder of the risks involved in investing. It is important to do your research and understand the underlying fundamentals of a company before making an investment. It is also important to diversify your portfolio and not put all your eggs in one basket.

Looking Ahead

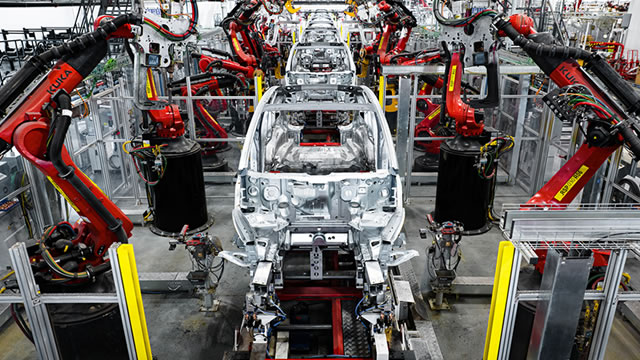

Despite the recent stock price decline, Tesla remains a company with a strong vision and a dedicated following. Elon Musk and his team are working on new products and technologies that have the potential to revolutionize the automotive and energy industries. As investors and observers, we will continue to watch Tesla closely and see how the company navigates the challenges ahead.

- Tesla’s stock price decline was a significant reversal from the all-time closing high of almost $480 reached on Dec. 17.

- The decline was due to several factors, including an SEC investigation into Elon Musk and overall market volatility.

- The impact on Tesla was a loss of market capitalization, making it more difficult to raise capital in the future.

- The impact on individuals is a reminder to do thorough research and diversify investments.

- Despite the challenges, Tesla remains a company with a strong vision and dedicated following.

In conclusion, the sudden drop in Tesla’s stock price on a Monday morning was a shock to many, but it is important to remember that the stock market is inherently volatile. For Tesla, the decline in stock price presents challenges, but the company remains focused on its vision and its dedicated customer base. For individuals, it is a reminder to do thorough research and diversify investments. As we look ahead, we will continue to watch Tesla closely and see how the company navigates the challenges ahead.