Wall Street’s Reaction to Alphabet and AMD’s Earnings: A Closer Look

In the ever-evolving world of tech investing, earnings reports serve as crucial milestones that provide insight into a company’s financial health and future prospects. Recently, two major players in the tech industry – Alphabet (GOOG, GOOGL) and Advanced Micro Devices (AMD) – have released their quarterly reports, sparking contrasting reactions from Wall Street investors.

Alphabet: A Mixed Bag of Results

Alphabet, the parent company of Google, reported a 23% year-over-year increase in quarterly revenues. However, the earnings missed analysts’ expectations, leading to a significant drop in the company’s stock price. The decline was primarily due to a decrease in Google’s advertising revenue growth, which some experts attribute to increased competition in the digital ad market.

AMD: Promising First Quarter Guidance and Flat Data Center Revenue

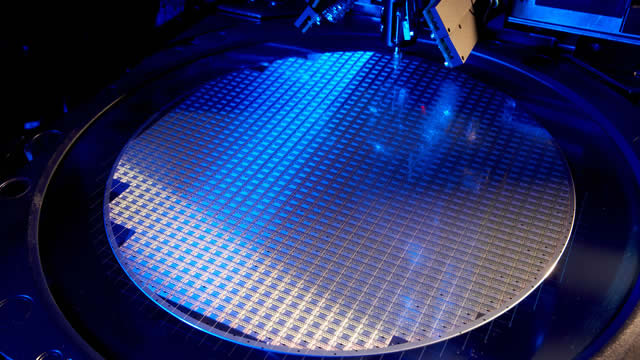

On the other hand, AMD’s earnings report brought a breath of fresh air to investors. The semiconductor manufacturer reported a 52% year-over-year increase in quarterly revenues, primarily driven by strong demand for its Ryzen and Epyc processors. AMD’s first quarter guidance also impressed investors, with expectations of continued growth in the coming quarters.

Impact on Individual Investors

For individual investors, the contrasting reactions to Alphabet and AMD’s earnings reports highlight the importance of a diversified investment portfolio. In the case of Alphabet, the miss on earnings expectations could potentially lead to short-term losses for investors. However, the company’s strong fundamentals and market dominance may provide opportunities for long-term gains.

On the other hand, AMD’s impressive earnings report and strong guidance could indicate potential upside for the stock. The company’s focus on innovation and competitive pricing in the semiconductor market has position it well for continued growth.

Impact on the World

Beyond the immediate impact on investors, the earnings reports of tech giants like Alphabet and AMD have broader implications for the tech industry and the world at large. The decline in Google’s advertising revenue growth could indicate a saturation point in the digital ad market, potentially leading to increased competition and innovation to drive growth.

In contrast, AMD’s strong earnings report and continued growth prospects could lead to increased competition in the semiconductor market, potentially driving down prices and increasing innovation. This could lead to benefits for consumers in the form of more affordable and advanced technology.

Conclusion

In conclusion, the recent earnings reports from Alphabet and AMD serve as a reminder of the importance of staying informed about the financial health and prospects of the companies in your investment portfolio. While the reports brought contrasting reactions from Wall Street investors, they also highlight the dynamic nature of the tech industry and the opportunities and challenges that come with it.

For individual investors, a diversified portfolio and a long-term perspective can help navigate the ups and downs of the market. And for the world, the continued innovation and competition in the tech industry could lead to advancements that benefit consumers and drive economic growth.

- Alphabet reported a 23% year-over-year increase in quarterly revenues but missed analysts’ earnings expectations, leading to a decline in stock price.

- AMD reported a 52% year-over-year increase in quarterly revenues and strong first quarter guidance, leading to an increase in stock price.

- Individual investors should consider a diversified portfolio and a long-term perspective to navigate the ups and downs of the market.

- The tech industry’s continued innovation and competition could lead to benefits for consumers and economic growth.