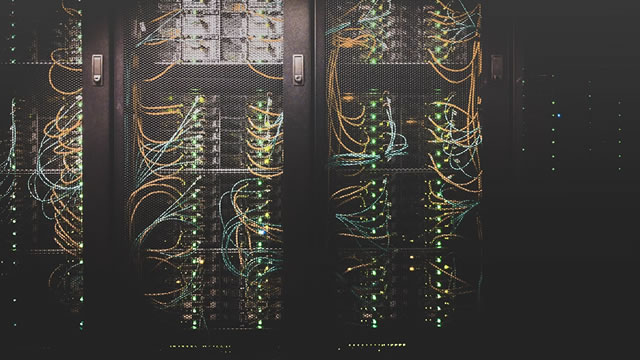

The Server Maker’s Surprising Revenue Guidance: A Closer Look

Last week, the server manufacturing industry was abuzz with excitement as one major player announced better-than-expected revenue guidance. Investors were thrilled, sending the stock price soaring. But as the initial euphoria subsided, questions began to surface about the company’s accounting practices.

Better-Than-Expected Revenues

The server maker, known for its innovative and high-performance servers, reported that its revenues for the upcoming quarter would be significantly higher than previously anticipated. The company attributed this unexpected surge to strong demand for its products in the cloud computing sector. This came as a pleasant surprise to investors, who had been bracing for a potential slowdown in the industry.

Accounting Concerns

However, the announcement was not all good news. Shortly after the revenue guidance was revealed, reports emerged about potential accounting irregularities. The company’s auditor expressed concerns about the validity of certain revenue recognition practices. This sent a wave of uncertainty through the market, causing some investors to question the reliability of the financial statements.

Impact on Investors

For individual investors, the situation presents a conundrum. On the one hand, the company’s strong revenue growth is a positive sign for the industry as a whole. On the other hand, the accounting concerns are a red flag that cannot be ignored. Some investors may choose to hold onto their shares, hoping that the company can address the accounting issues and restore confidence. Others may decide to sell, given the uncertainty.

- Individual investors should closely monitor the company’s financial statements and any updates from the auditor.

- They may also want to consider diversifying their portfolio to minimize risk.

- Investors should consult with a financial advisor before making any major decisions.

Impact on the Industry

The server maker’s revenue guidance and accounting concerns are not just an issue for its investors. The entire industry could be affected. If the company’s accounting practices are found to be in violation of accounting standards, it could lead to increased scrutiny of other companies in the sector. This could result in additional regulatory oversight and potential fines or penalties. Moreover, it could dampen investor confidence in the industry as a whole, making it more difficult for companies to raise capital.

Conclusion

The server maker’s better-than-expected revenue guidance was a welcome surprise for investors, but the accounting concerns that followed cast a dark cloud over the industry. Individual investors should closely monitor the situation and consider diversifying their portfolio. The industry as a whole could face increased regulatory scrutiny and decreased investor confidence, making it a challenging time for companies seeking to raise capital. Only time will tell how this situation unfolds, but one thing is certain: transparency and accuracy in financial reporting are more important than ever.

Stay tuned for more insights and analysis on the latest developments in the tech industry.