James Hardie Industries Plc: A Hidden Gem in the Building Materials Sector

James Hardie Industries plc, a leading global manufacturer of fiber cement products and building solutions, has been flying under the radar for many investors. Headquartered in Dublin, Ireland, the company operates in three key regions: North America, Asia Pacific, and Europe. With a market capitalization of nearly $15 billion, James Hardie Industries may not be a household name, but it’s making waves in the building materials sector.

Business Focus

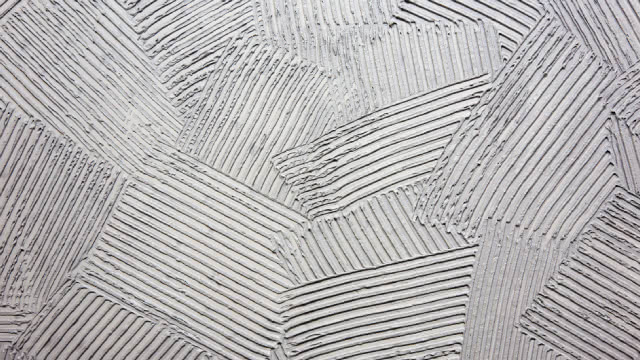

James Hardie Industries specializes in fiber cement and building products for residential construction. Fiber cement is a high-performance alternative to traditional building materials like wood and vinyl. It’s known for its durability, fire resistance, and low maintenance requirements. By focusing on this niche, James Hardie Industries has carved out a unique position in the market.

Market Coverage and Stock Buyback

Despite its impressive market capitalization, James Hardie Industries receives limited coverage from Wall Street. This lack of attention could be an opportunity for investors seeking undervalued stocks. Additionally, the company’s ongoing share buyback program is a positive sign. James Hardie Industries has committed to buying back up to $1 billion worth of its shares, which could help boost earnings per share and increase the value of remaining shares.

Operating in a Challenging Housing Market

The housing sector is currently facing considerable uncertainty. Factors like rising interest rates, inflation, and supply chain disruptions have contributed to a slowdown in the housing market. However, James Hardie Industries has demonstrated resilience in these challenging conditions. The company’s diversified business model, strong financial position, and focus on innovation have helped it weather market volatility.

Impact on Individuals

If you’re an individual investor, James Hardie Industries could be an intriguing addition to your portfolio. Its focus on fiber cement, a high-growth niche, and its strong financial position make it an attractive investment opportunity. Additionally, its ongoing share buyback program could help boost your returns. However, as with any investment, it’s important to do your own research and consider your risk tolerance.

Impact on the World

On a larger scale, James Hardie Industries’ success could have a positive impact on the world. The company’s innovative building solutions can help reduce the environmental impact of construction. For instance, fiber cement is a more sustainable alternative to traditional building materials. Additionally, James Hardie Industries’ focus on innovation could lead to new, more efficient building methods and materials, helping to address the global housing crisis.

Conclusion

James Hardie Industries plc is a hidden gem in the building materials sector. Its focus on fiber cement and building solutions, strong financial position, and ongoing share buyback program make it an attractive investment opportunity. Despite operating in a challenging housing market, the company has demonstrated resilience and innovation. For individuals and institutions alike, James Hardie Industries could be a valuable addition to your portfolio. And on a larger scale, its success could help address global housing needs and reduce the environmental impact of construction.

- James Hardie Industries is a leading global manufacturer of fiber cement and building products for residential construction.

- The company operates in North America, Asia Pacific, and Europe.

- Despite a market capitalization of nearly $15 billion, James Hardie Industries receives limited coverage from Wall Street.

- The company is committed to buying back up to $1 billion worth of its shares.

- James Hardie Industries has demonstrated resilience in challenging housing market conditions.

- The company’s focus on fiber cement and innovation could help reduce the environmental impact of construction.