Exploring QuickLogic (QUIK): A Stock Worth Watching for Prospective Investors

In the dynamic world of technology and finance, it’s essential for investors to keep a close eye on stocks that show potential for growth. One such company that has recently piqued the interest of Zacks.com users is QuickLogic Corporation (QUIK). Let’s delve deeper into the facts that could influence the stock’s future.

Company Overview

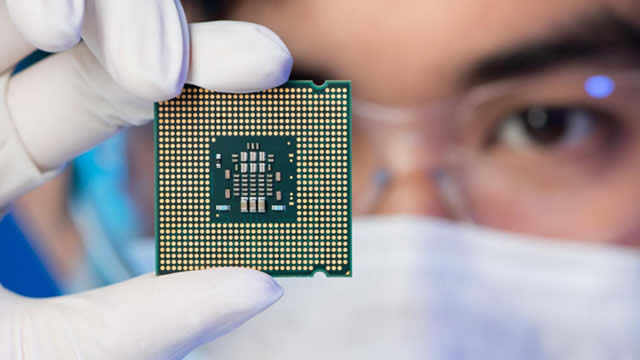

QuickLogic is a silicon solutions provider focusing on innovative semiconductor technologies and Intellectual Property (IP) for mobile, wearable, home, industrial, automotive, and IoT applications. The company’s primary offerings include Eco-system-on-Chip (SoC), Voice-Enabled Semiconductor Solutions, and Smart Connected Solutions.

Financial Performance

QuickLogic’s financial performance has shown signs of improvement in recent quarters. In their Q2 2021 earnings report, the company reported a 35% increase in revenue compared to the previous year, totaling $10.5 million. The net loss was $3.2 million, a significant decrease from the $5.4 million net loss reported in the same quarter the previous year. This improved financial performance could be a positive sign for potential investors.

Product Portfolio

QuickLogic’s diverse product portfolio is a significant strength. Their Eco-system-on-Chip solutions offer a low-power, high-performance alternative to traditional application processors. The Voice-Enabled Semiconductor Solutions include the EchoNest voice processor, which powers Alexa, Google Assistant, and other popular voice assistants. Lastly, their Smart Connected Solutions allow devices to connect to the cloud, enabling advanced features such as over-the-air updates and remote monitoring.

Market Opportunities

The market opportunities for QuickLogic are vast, particularly in the IoT and automotive industries. According to a report by Grand View Research, the IoT market is expected to reach $1,673.6 billion by 2025, growing at a CAGR of 21.5% during the forecast period. QuickLogic’s low-power, high-performance SoCs are well-positioned to cater to this growing market. Similarly, the automotive semiconductor market is projected to reach $113.8 billion by 2026, driven by the increasing demand for advanced driver assistance systems (ADAS) and electric vehicles (EVs). QuickLogic’s expertise in semiconductor technologies and IP could enable them to tap into this market.

Impact on Individuals

For individuals interested in investing, QuickLogic’s potential for growth could make it an attractive option. As the company continues to innovate and expand its offerings, it could lead to increased revenue and potential profit for shareholders. Additionally, the growing market opportunities in IoT and automotive industries could translate to long-term growth for QuickLogic, making it an intriguing investment prospect.

Impact on the World

The impact of QuickLogic on the world could be significant, particularly in the realm of technology and connectivity. Their low-power, high-performance SoCs could enable the mass adoption of IoT devices, making our world more connected and efficient. In the automotive industry, QuickLogic’s semiconductor solutions could contribute to the development of advanced driver assistance systems and electric vehicles, paving the way for a more sustainable and technologically advanced transportation system.

Conclusion

In conclusion, QuickLogic’s recent financial performance, diverse product portfolio, and market opportunities make it a stock worth watching for prospective investors. With a focus on innovation and a strong presence in growing markets such as IoT and automotive, the company could deliver significant returns for shareholders. As the world becomes increasingly connected, QuickLogic’s role in providing the underlying semiconductor technologies could contribute to a more efficient, sustainable, and technologically advanced future.

- QuickLogic is a silicon solutions provider with offerings in SoCs, voice-enabled semiconductor solutions, and smart connected solutions.

- The company reported improved financial performance in Q2 2021, with a 35% increase in revenue and a significant decrease in net loss.

- QuickLogic’s diverse product portfolio caters to growing markets such as IoT and automotive, with opportunities for low-power, high-performance solutions.

- The market opportunities for QuickLogic are vast, particularly in the IoT and automotive industries, which are expected to grow significantly in the coming years.

- For individuals, investing in QuickLogic could lead to potential profit as the company continues to innovate and expand its offerings.

- The impact of QuickLogic on the world could be significant, with their semiconductor technologies contributing to a more connected, efficient, and technologically advanced future.