FSLR’s Q4 Results: Robust Top-Line Performance Amid Warranty Charges

First Solar, Inc. (FSLR), a leading global provider of comprehensive photovoltaic (PV) solar systems, is gearing up for the release of its fourth-quarter (Q4) 2022 financial results. The company’s management team has indicated that the quarter is expected to reflect robust top-line performance, driven by capacity expansion and strong demand. However, this growth will be partially offset by warranty charges.

Capacity Expansion and Strong Demand

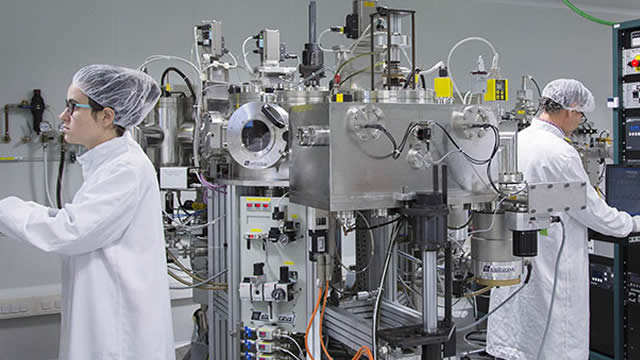

First Solar has been actively expanding its manufacturing capacity in recent months. The company’s Series 6 thin-film PV module manufacturing line in Perrysburg, Ohio, is ramping up production, and the new 3.3 GW (gigawatt) factory in India is expected to begin production in the second half of 2023. This capacity expansion will enable First Solar to meet the growing demand for solar energy solutions, particularly in the utility-scale sector.

Strong Demand for Solar Energy Solutions

The global demand for solar energy solutions has been on the rise, fueled by the increasing focus on renewable energy sources and the drive to reduce carbon emissions. According to the International Energy Agency (IEA), solar PV is expected to be the fastest-growing source of electricity generation through 2025. The demand for solar energy is particularly strong in emerging markets, such as India, Southeast Asia, and the Middle East, where governments are investing heavily in renewable energy to meet their growing energy needs.

Warranty Charges

Despite the robust top-line growth, First Solar’s Q4 results will be partially offset by warranty charges. The company has been experiencing higher-than-expected warranty claims due to module degradation caused by extreme weather conditions, such as high temperatures and humidity. First Solar’s management team has acknowledged the issue and is taking steps to address it, including the implementation of new manufacturing processes and the development of more durable modules.

Impact on Consumers

For consumers, the Q4 results of First Solar may not have a significant impact, as the company primarily focuses on the utility-scale solar market. However, the strong demand for solar energy solutions and the ongoing capacity expansion are positive signs for the industry as a whole. This trend is expected to lead to lower solar panel prices and increased availability, making solar energy more accessible and affordable for consumers.

Impact on the World

The robust top-line performance of First Solar and the overall growth of the solar energy sector are significant developments for the world. The transition to renewable energy sources is crucial for reducing greenhouse gas emissions and mitigating the effects of climate change. According to the IEA, renewable energy is expected to account for 95% of the increase in global power capacity through 2026. The ongoing expansion of solar energy capacity will contribute to a more sustainable and cleaner energy future for the world.

Conclusion

First Solar’s Q4 2022 results are expected to reflect robust top-line performance, driven by capacity expansion and strong demand, amid warranty charges. The ongoing expansion of solar energy capacity and the increasing demand for solar energy solutions are positive signs for the industry and the world. These trends are expected to lead to lower solar panel prices, increased availability, and a more sustainable and cleaner energy future.

- First Solar’s Q4 2022 results are expected to reflect robust top-line performance, driven by capacity expansion and strong demand.

- The ongoing expansion of solar energy capacity and the increasing demand for solar energy solutions are positive signs for the industry and the world.

- Lower solar panel prices and increased availability are expected as a result of these trends.

- The transition to renewable energy sources is crucial for reducing greenhouse gas emissions and mitigating the effects of climate change.