Robinhood’s Impressive Earnings Report for Q4 2024

A Game-Changing Quarter for Robinhood Markets:

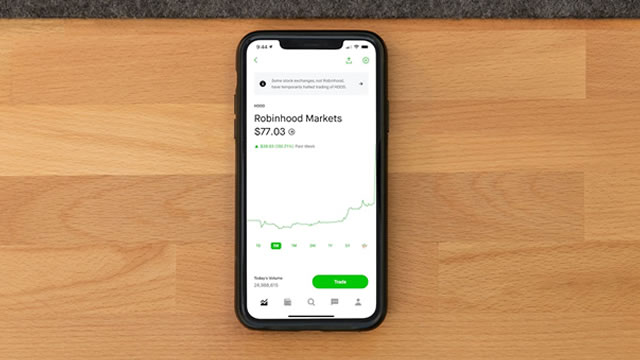

Robinhood Markets (HOOD 4.82%), a prominent fintech platform known for commission-free trading, recently announced a remarkable earnings report for the fourth quarter of 2024. On February 12, the company reported earnings per share (EPS) of $1.01, vastly surpassing expectations of $0.42. This unexpected surge in earnings has left investors and analysts alike in awe, as Robinhood continues to defy expectations and make waves in the financial world.

The Rise of Robinhood:

Founded in 2013, Robinhood quickly gained popularity for its user-friendly interface and disruptive business model that eliminated trading fees. This approach attracted a new generation of traders who were eager to participate in the stock market without the traditional barriers to entry. Over the years, Robinhood has continued to innovate and expand its offerings, becoming a household name in the world of investing.

What This Means for Investors:

For investors, Robinhood’s impressive earnings report is a clear signal of the company’s growth potential and financial strength. The higher-than-expected EPS indicates that Robinhood’s business model is thriving and that it is well-positioned for future success. This news is likely to spark renewed interest in the company’s stock and could lead to a surge in its valuation.

Impact on the Financial World:

Robinhood’s stellar performance in Q4 2024 is not only significant for investors but also for the financial industry as a whole. The company’s success challenges traditional brokerage firms and highlights the changing landscape of investment platforms. Robinhood’s ability to attract a new generation of investors and generate substantial earnings underscores the growing influence of fintech companies in the market.

Conclusion:

Overall, Robinhood’s remarkable earnings report for the fourth quarter of 2024 is a testament to the company’s innovative approach to investing and its relentless pursuit of growth. As Robinhood continues to disrupt the financial industry and appeal to a diverse range of traders, its impact on the market is expected to be profound and long-lasting. Investors and industry observers alike will be eagerly watching to see what the future holds for this trailblazing fintech platform.

How Robinhood’s Earnings Report Will Affect You:

Direct Impact on Investors:

For individual investors who own Robinhood stock, the impressive earnings report for Q4 2024 is likely to result in a boost in the value of their holdings. The higher-than-expected EPS indicates strong financial performance and growth potential, which could lead to increased demand for the stock and drive up its price. This could translate to higher returns for investors who have a stake in Robinhood.

How Robinhood’s Earnings Report Will Affect the World:

Changing the Financial Landscape:

Robinhood’s stellar earnings report for Q4 2024 is set to have a significant impact on the financial world at large. The company’s success challenges traditional brokerage firms and signals the rise of fintech platforms as key players in the industry. As Robinhood continues to attract a new generation of investors and reshape the way people approach investing, the effects of its growth and innovation are likely to reverberate throughout the market.