Why Advanced Micro Devices (AMD) Stock Is Slumping Despite Growing Demand

The Rise and Fall of AMD

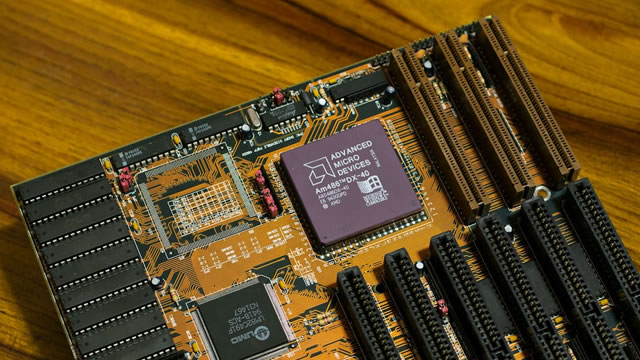

Advanced Micro Devices (AMD) has been a major player in the semiconductor industry for years. Known for its innovative products and cutting-edge technology, AMD has seen significant success in the artificial intelligence (AI) accelerator market, as well as gaining market share in the PC and server CPU markets. However, despite these achievements, AMD’s stock has been on a downward trend over the past year.

Since reaching its peak in early 2024, AMD’s stock has dropped nearly 50%. This decline has left investors puzzled, as the demand for AI accelerators continues to soar and AMD continues to make strides in the competitive CPU market. So, what is causing this slump in AMD’s stock price?

Factors Contributing to AMD’s Stock Decline

One factor that may be impacting AMD’s stock price is increased competition in the semiconductor industry. Rival companies such as Intel and NVIDIA have been making significant strides in the AI accelerator market, posing a threat to AMD’s market share. Additionally, supply chain issues and global economic uncertainty may also be contributing to the decline in AMD’s stock price.

Furthermore, AMD’s stock may be facing pressure from overall market conditions, such as rising interest rates and inflation concerns. These macroeconomic factors can impact investor sentiment and cause stock prices to fluctuate.

How AMD’s Stock Decline Could Affect You

If you are an investor in AMD or thinking about investing in the company, the decline in AMD’s stock price may have a direct impact on your portfolio. It is important to closely monitor market trends and company performance to make informed investment decisions.

How AMD’s Stock Decline Could Affect the World

As a major player in the semiconductor industry, AMD’s stock decline could have broader implications for the global economy. A weakened AMD could potentially impact the development and availability of cutting-edge technology, as well as the competitiveness of the semiconductor market as a whole.

Conclusion

While Advanced Micro Devices (AMD) continues to be a key player in the semiconductor industry, the recent decline in its stock price is a cause for concern. As investors and industry experts continue to monitor market trends and company performance, the future of AMD remains uncertain. It is important for stakeholders to stay informed and adapt to changing market conditions in order to navigate the challenges ahead.