Teradyne: A Closer Look at Recent Price Drops

The Situation

If you’ve been keeping an eye on the stock market lately, you may have noticed Teradyne’s price taking a hit. The company’s shares have experienced a significant drop, which some see as an overreaction. But is there more to the story?

AI-Driven Growth

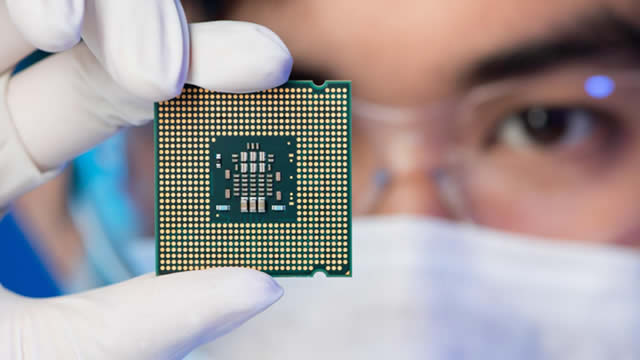

Despite the recent turmoil, Teradyne seems to have a lot going for it. The growth potential in the AI-driven System on Chip (SoC) market is a major positive. As the demand for AI technologies continues to rise, the total addressable market (TAM) for SoC is expected to grow exponentially. This presents a great opportunity for Teradyne to capitalize on this trend.

Semi Testing Segment

Teradyne’s Semi Testing segment also shows promise, especially with the increasing use of AI applications driving TAM expansion. This segment is a key driver of the company’s revenue growth and profitability.

Challenges Ahead

However, not everything is smooth sailing for Teradyne. The robotics segment, in particular, is facing challenges with low margins and slow growth. This is something that management needs to address in order to fully capitalize on the company’s potential.

Risks and Rewards

Management’s optimistic targets for 2028 revenue and earnings per share imply significant growth ahead. But there are risks to consider, such as market conditions and competition from Chinese companies. These factors could impact Teradyne’s future performance.

How It Will Affect You

As an investor, the recent price drop in Teradyne’s stock could be seen as a buying opportunity. With the company’s strong position in the AI and Semi Testing markets, there is potential for significant returns in the long run.

Global Implications

On a larger scale, Teradyne’s growth and performance have the potential to impact the technology industry as a whole. With the company’s focus on AI-driven technologies, it could drive innovation and shape the future of the industry.

Conclusion

Teradyne’s recent price drop may be seen as an overreaction, but the company’s prospects remain strong. With opportunities in the AI and Semi Testing markets, there is potential for growth and success. However, challenges and risks must also be considered as part of the equation.