Lam Research’s Q2-2025 Earnings Beat Expectations: A Closer Look

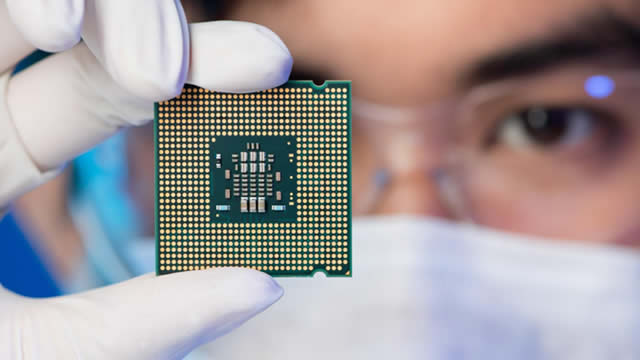

Lam Research, a leading supplier of wafer fabrication equipment and services to the semiconductor industry, recently reported its Q2-2025 earnings, exceeding analysts’ expectations. The company delivered strong revenue and earnings per share (EPS) growth, along with positive guidance for Q3, which resulted in a significant boost to the stock price of over 7%.

The impressive performance of Lam Research in Q2-2025 can be attributed to several growth catalysts that are driving the company’s success. These include the increasing demand for high-bandwidth memory, the adoption of gate-all-around transistors, and the growth of advanced packaging technologies. With its focus on innovation and technology leadership, Lam Research is well-positioned to outgrow the overall wafer fab equipment market in the coming quarters.

However, despite the positive outlook and growth potential, some analysts have expressed concerns about the elevated valuation of Lam Research’s stock. At its current price, the stock may be trading at a premium, making it less attractive for investors looking for value opportunities. A more favorable entry point for potential investors could be in the $70-75 range, where the stock may offer better upside potential.

How This Will Affect Me

As an individual investor, the strong performance of Lam Research and its stock price appreciation can have both positive and negative implications for me. On one hand, if I already hold shares of the company, the increase in stock price will contribute to the growth of my investment portfolio. However, if I am considering investing in Lam Research at this point, the elevated valuation may make me hesitant to enter the market and wait for a more favorable price level.

How This Will Affect the World

From a broader perspective, the success of Lam Research and its continued innovation in semiconductor manufacturing technologies have significant implications for the world economy. As a key player in the semiconductor industry, Lam Research’s growth and expansion can drive advancements in technology, create job opportunities, and contribute to the development of cutting-edge products that impact various industries and sectors globally.

Conclusion

In conclusion, Lam Research’s strong performance in Q2-2025 and its positive growth outlook highlight the company’s position as a leader in the semiconductor equipment market. While the stock may be trading at a premium valuation currently, the company’s focus on innovation and industry trends make it a promising investment opportunity for the future. As investors assess their options, keeping an eye on potential entry points and considering the long-term growth prospects of Lam Research will be key in making informed investment decisions.