Welcome to my quirky corner of the internet!

Jim Lebenthal: The Man, The Myth, The Chief Equity Strategist

Hey there, fellow finance enthusiasts! Today, I want to talk about the one and only Jim Lebenthal, Chief Equity Strategist at Cerity Partners. If you’re anything like me, you’ve probably seen him on CNBC’s “Halftime Report” dropping knowledge bombs left and right. And let me tell you, this guy knows his stuff!

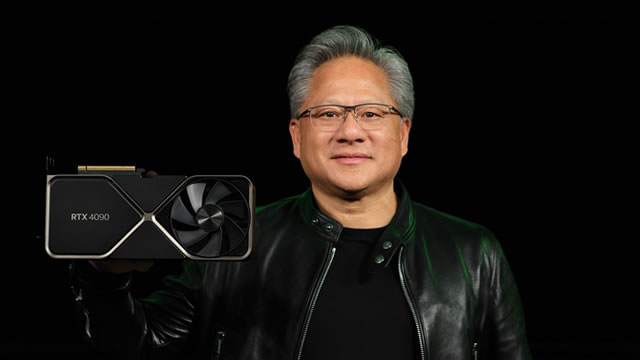

Recently, Jim Lebenthal made waves in the investment world by announcing that he’s trimming his position in Nvidia. Now, if you’re not familiar with Nvidia, they’re a powerhouse in the semiconductor industry. So, why is Jim making this move? Well, according to him, it’s all about diversification and risk management. Smart move, Jim!

Diving Deeper into Nvidia and Jim Lebenthal’s Strategy

Let’s break it down a bit further. Nvidia has been on a tear lately, with their stock price soaring to new heights. But as any savvy investor knows, what goes up must come down. By trimming his position in Nvidia, Jim Lebenthal is taking a proactive approach to protect his portfolio from potential downside risk. And honestly, can you blame him?

It’s not about being bearish on Nvidia, it’s about being realistic. Markets can be unpredictable, and having a diversified portfolio is key to weathering any storm that may come our way. Jim Lebenthal’s decision to trim Nvidia may seem bold to some, but to me, it’s just good old-fashioned risk management.

How Jim Lebenthal’s Move Could Impact You

So, how will Jim Lebenthal’s decision to trim Nvidia affect you, the average investor? Well, it all comes down to diversification. If you’ve been following Jim’s lead and have a stake in Nvidia, it might be a good idea to reassess your portfolio. Consider reallocating some of your holdings to other sectors or industries to spread out your risk.

Remember, no investment is foolproof. By taking a page out of Jim Lebenthal’s playbook and being proactive about managing risk, you’ll be better positioned to weather any market fluctuations that come your way. So, take a cue from the Chief Equity Strategist himself and think about trimming your Nvidia position too.

The Global Impact of Jim Lebenthal’s Move

Now, let’s widen our lens and look at how Jim Lebenthal’s decision to trim Nvidia could impact the world at large. As a major player in the semiconductor industry, Nvidia’s stock performance can have ripple effects on global markets. By taking a step back from Nvidia, Jim Lebenthal is signaling to the investment community that it’s important to stay vigilant and be mindful of potential risks.

This move could serve as a wake-up call for other investors to reassess their own portfolios and consider diversifying beyond popular tech stocks like Nvidia. In a world where market volatility is the norm, being proactive about risk management is crucial for long-term success. Jim Lebenthal’s decision to trim Nvidia may just be the nudge that investors need to take a closer look at their own investment strategies.

In Conclusion…

And there you have it! Jim Lebenthal’s choice to trim Nvidia is not just a simple transaction – it’s a strategic move to safeguard his portfolio and advise others to do the same. Whether you’re an individual investor or a global market watcher, there’s something to be learned from Jim’s approach to risk management. So, here’s to smart investing and staying one step ahead of the game!