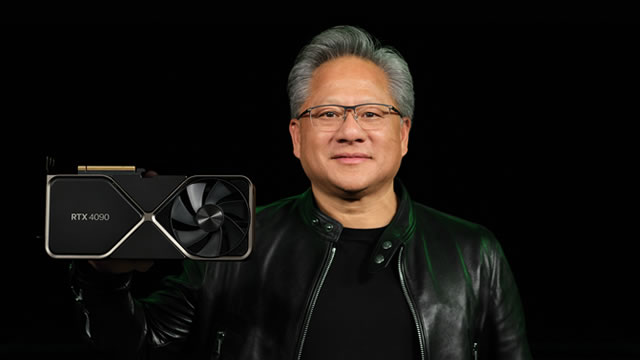

Monday Madness: Nvidia Takes a Hit

Monday, January 27, was a day that will go down in financial history as a veritable bloodbath. The markets were in chaos, with investors panicking and stock prices plummeting. Among the hardest-hit companies was Nvidia (NASDAQ: NVDA), a giant in the semiconductor industry.

The Fallout

As news of Nvidia’s plummeting stock prices spread, panic ensued among shareholders and investors. The company’s shares dropped by a significant percentage, causing losses for many who had invested in the tech giant. Analysts scrambled to make sense of the sudden decline, with some pointing to concerns over slowing demand for Nvidia’s products, while others cited broader economic factors at play.

What This Means for You

For individual investors, Nvidia’s woes may have a ripple effect on their portfolios. If you own shares in the company, you may have experienced a sharp decrease in your investment value. It’s a reminder of the unpredictable nature of the stock market and the importance of diversifying your investments to mitigate risk.

The Global Impact

On a larger scale, Nvidia’s struggles could have broader implications for the tech industry and the global economy. As a major player in the semiconductor market, Nvidia’s performance is closely watched as a barometer of the overall health of the technology sector. If the company continues to struggle, it could signal trouble ahead for other tech companies and potentially impact economic growth worldwide.

Conclusion

Monday’s market mayhem was a stark reminder of the volatility of the financial world. Nvidia’s struggles serve as a cautionary tale for investors and a wake-up call for the tech industry as a whole. As we navigate these uncertain times, it’s more important than ever to stay informed, remain vigilant, and be prepared for whatever the markets may throw our way.