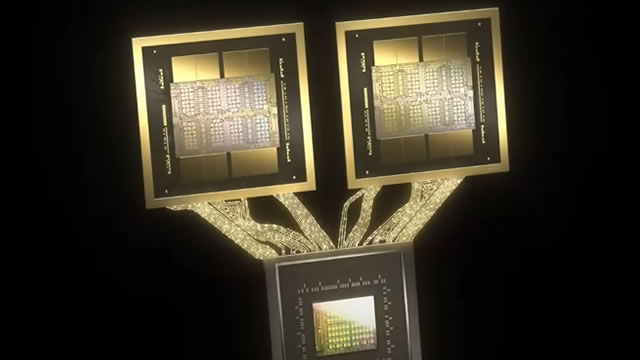

The Impact of Cheaper Artificial Intelligence from China on Wall Street

Emotions Running High as Wall Street Takes a Hit

Wall Street had a rough start to the week on concern that a cheaper artificial intelligence-model from China could threaten the dominance of US technology, spurring a selloff in stocks and a flight to haven assets. From New York to London and Tokyo, equities got hammered, with the S&P 500 dropping 1.9% and the Nasdaq 100 down 3.1%.

Investors and analysts were caught off guard by the news of a cheaper AI model coming out of China that could potentially disrupt the current tech landscape. The fear of losing out to foreign competition was palpable, leading to a panic selling of stocks and a rush towards safer assets.

How Will This Impact Me?

As an individual investor, the repercussions of this event may be felt in your portfolio. The sudden drop in stock prices could lead to losses if you are heavily invested in tech companies. It’s important to reassess your investment strategy and consider diversifying your portfolio to mitigate risk.

How Will This Impact the World?

The implications of a cheaper AI model from China are far-reaching. It could potentially shift the balance of power in the global tech industry, as Chinese companies gain a competitive edge over their US counterparts. This could lead to a restructuring of the tech landscape, with implications for innovation, job creation, and economic growth.

In Conclusion

It’s clear that the news of a cheaper AI model from China has sent shockwaves through Wall Street and the global tech community. The uncertainty surrounding the implications of this development has led to a tumultuous start to the week for investors. Moving forward, it will be crucial for stakeholders to closely monitor the situation and adapt their strategies to navigate the changing tech landscape.