I forecast ASML Holding N.V.’s 2025/2026 revenue growth

The Power of High-NA EUV Adoption

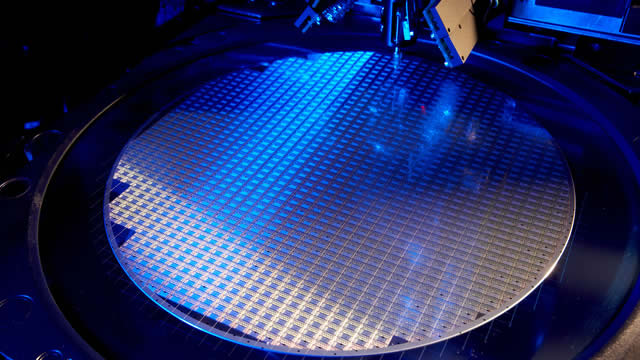

ASML Holding N.V., a leading provider of advanced technology for the semiconductor industry, is poised for significant growth in the coming years. With a forecasted annual revenue growth of 15% for 2025/2026, ASML is set to outperform its competitors in the market. This growth is driven by the increasing adoption of High-NA EUV technology, which offers superior performance and precision in semiconductor manufacturing.

My $1,290 price target for ASML indicates a 31.5% two-year compound annual growth rate. The current valuation of the company includes a 25% safety margin, making it an attractive investment opportunity for value investors. ASML’s monopoly in EUV lithography, strategic partnerships, and the growing demand for AI-driven solutions further solidify its competitive position in the market.

Challenges and Opportunities

Despite its strong position, ASML faces challenges such as potential reduced revenue from Chinese customers and geopolitical tensions related to Taiwan. However, the company’s diversified customer base and innovative technology solutions mitigate these risks to a certain extent. As a value trade, ASML offers the potential for 30%+ annual returns over the next two years, supported by a projected $39 billion revenue for fiscal year 2026 and stabilized profit margins.

How This Will Affect Me

As an investor, the forecasted growth of ASML Holding N.V. presents an opportunity to capitalize on the company’s success in the semiconductor market. By investing in ASML, I can potentially achieve significant returns and grow my investment portfolio over the next few years.

How This Will Affect the World

The growth of ASML Holding N.V. is not only beneficial for investors but also for the global semiconductor industry. ASML’s innovative technology solutions and strategic partnerships drive advancements in semiconductor manufacturing, leading to more efficient and powerful electronic devices. This ultimately contributes to technological progress and economic growth on a global scale.

Conclusion

In conclusion, the forecasted revenue growth of ASML Holding N.V. signals a promising future for the company and the semiconductor industry as a whole. With its strong competitive position, innovative technology solutions, and strategic partnerships, ASML is well-positioned to drive value for investors and make a significant impact on the world stage.