Nvidia’s $5.5B Charge: A Deep Dive into the Impact of New Export Controls

On a recent Tuesday, Nvidia Corporation, a leading American technology company, disclosed in a Securities and Exchange Commission (SEC) filing that it anticipates incurring charges amounting to approximately $5.5 billion due to new export regulations. These charges stem from Nvidia’s H20 chips, which were specifically designed to comply with the Biden-era export controls.

Background on Nvidia and the H20 Chips

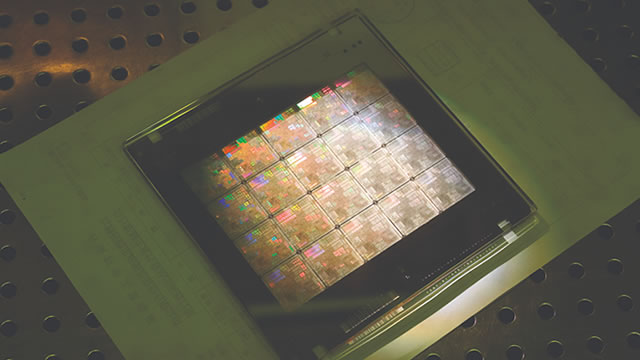

Nvidia, headquartered in Santa Clara, California, is renowned for producing graphics processing units (GPUs) and system-on-a-chip units for the gaming and professional markets. These advanced technologies are essential for applications such as artificial intelligence, autonomous vehicles, and high-performance computing. The H20 chips, a part of Nvidia’s A100 data center GPUs, are designed to meet the stringent requirements of the Department of Commerce’s Bureau of Industry and Security (BIS) and other export control agencies.

The New Export Controls and Their Impact on Nvidia

The new export controls, which came into effect in late 2021, target advanced technologies that have potential military applications. These regulations aim to limit the export of such technologies to specific countries, primarily China, due to national security concerns. In the case of Nvidia, the H20 chips are affected as they contain certain technologies that are subject to these export controls.

Financial Consequences for Nvidia

The SEC filing indicates that Nvidia expects to recognize these charges primarily in the first quarter of its fiscal year 2023. The charges will consist of two parts: an estimated $4.0 billion to $4.5 billion for the cost of the impacted H20 chips and related inventory, and an additional $1.0 billion to $1.5 billion for the estimated cost of non-recurring engineering, manufacturing, and logistics expenses.

Implications for Consumers and the Technology Industry

The impact of these export controls on consumers and the technology industry is a subject of ongoing debate. Some argue that the restrictions could lead to price increases for advanced technologies, as companies may need to absorb the costs of redesigning and manufacturing chips that comply with the new regulations. Others contend that the controls could potentially slow down the pace of technological innovation, as companies may be deterred from investing in research and development due to the uncertainty surrounding export regulations.

The Wider Implications: A Global Perspective

-

Countries such as China, which are major consumers of advanced technologies, could face supply chain disruptions as a result of these export controls. This could potentially lead to a shift towards in-house production of these technologies or the establishment of alternative supply chains.

-

The technology industry as a whole could witness a wave of consolidation, as smaller companies may struggle to navigate the complexities and costs of complying with these regulations.

-

International cooperation and dialogue will be crucial in addressing the challenges posed by these export controls. Governments, industry leaders, and academic institutions must work together to find solutions that promote technological innovation while ensuring national security and international stability.

Conclusion

Nvidia’s $5.5 billion charge serves as a stark reminder of the far-reaching implications of new export controls on the technology industry. While the immediate financial consequences are clear, the long-term effects on consumers, the industry, and the global economy remain uncertain. As the situation unfolds, it is essential that all stakeholders work together to find a balanced solution that fosters technological innovation while addressing national security concerns.