The Upcoming Quarterly Results of Taiwan Semiconductor: A Crucial Moment for Wall Street

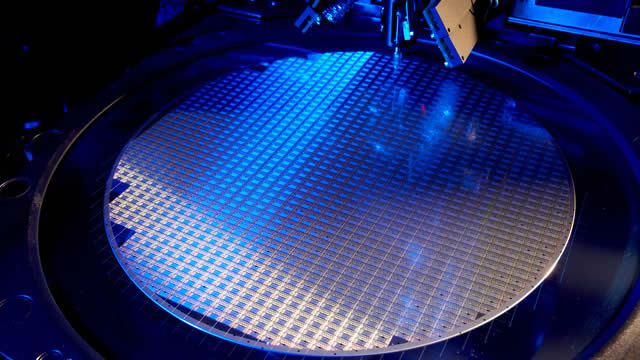

Taiwan Semiconductor Manufacturing Company Ltd. (TSM), the world’s leading semiconductor foundry, is preparing to report its first-quarter financial results on Thursday, April 17. This event is of significant importance, as TSM is responsible for producing approximately 50% of the global supply of semiconductor chip components. The semiconductor industry plays a vital role in powering numerous technological innovations, from smartphones and computers to automobiles and healthcare equipment.

TSM’s Impact on the Semiconductor Industry

TSM’s dominance in semiconductor manufacturing is a result of its advanced technology, operational efficiency, and strong customer relationships. The company has consistently invested in research and development, enabling it to produce chips using the most cutting-edge processes. TSM’s commitment to innovation has made it the preferred supplier for many leading technology companies, including Apple, Qualcomm, and NVIDIA.

Impact on Wall Street: Expectations and Market Reactions

Given TSM’s market position and the current state of the semiconductor industry, investors are closely watching the company’s Q1 results. Analysts anticipate that TSM’s revenue for the quarter will grow year-over-year, driven by strong demand for 5G infrastructure, automotive applications, and consumer electronics. However, there are concerns about potential supply chain disruptions due to the ongoing global chip shortage and geopolitical tensions between the US and China.

The market reaction to TSM’s Q1 results could be significant. A strong performance, particularly in light of these challenges, could boost investor confidence in the semiconductor sector and send TSM’s stock price higher. Conversely, a disappointing report could lead to profit-taking and a decline in the company’s share price.

Impact on Consumers and Businesses

Beyond Wall Street, TSM’s Q1 results could have far-reaching consequences for consumers and businesses. A strong quarter for TSM would likely lead to continued innovation and improved technology in a wide range of products. For instance, the production of more advanced chips could lead to faster and more energy-efficient smartphones, laptops, and servers. In the automotive sector, the development of more sophisticated semiconductors could pave the way for the mass production of self-driving cars.

Geopolitical Implications

Geopolitical tensions, particularly between the US and China, could also impact TSM’s results and the broader semiconductor industry. The US has imposed export controls on certain semiconductor technologies, citing national security concerns. These restrictions could limit TSM’s ability to supply chips to Chinese companies, potentially disrupting global supply chains and affecting TSM’s financial performance.

Conclusion

In conclusion, Taiwan Semiconductor’s Q1 results on April 17 are of great importance to investors, consumers, and businesses alike. TSM’s dominance in semiconductor manufacturing and its role in powering technological innovation make its financial performance a leading indicator of the health and direction of the industry. As the world continues to grapple with the challenges of chip shortages and geopolitical tensions, TSM’s Q1 report will provide valuable insights into the semiconductor sector’s ability to adapt and thrive.

- TSM is responsible for producing around 50% of the world’s semiconductor chip components.

- Investors closely watch TSM’s financial results due to its market position and the current state of the semiconductor industry.

- A strong Q1 report could lead to increased investor confidence and higher stock prices.

- A disappointing report could lead to profit-taking and lower stock prices.

- Strong Q1 results could lead to continued innovation and improved technology in various products.

- Geopolitical tensions, particularly between the US and China, could impact TSM’s financial performance.