Johnson & Johnson’s Upcoming Q1 Earnings Release: A Detailed Analysis

Johnson & Johnson (JNJ), a leading multinational corporation specializing in pharmaceuticals, medical devices, and consumer packaged goods, is set to announce its financial results for the first quarter of 2023 before the market opens on Tuesday, April 15. This announcement comes at an intense and profit-focused time for investors, as the earnings season is in full swing, and the market’s attention is heavily on companies’ financial performances.

Company Overview

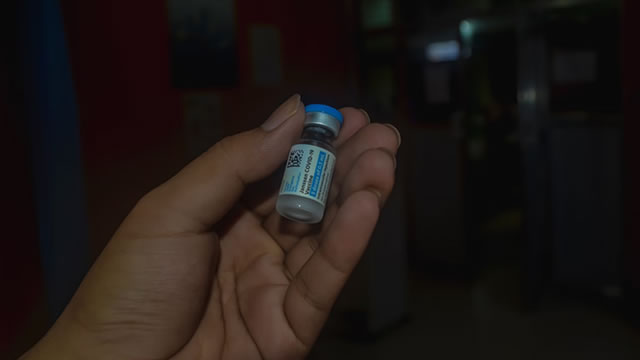

Johnson & Johnson is a well-established name in the corporate world, with a rich history that spans over 135 years. The company’s diverse portfolio includes household brands such as Band-Aid, Tylenol, and Neutrogena. In the healthcare sector, JNJ is a significant player, with its pharmaceutical segment accounting for a substantial portion of its revenue. Some of its blockbuster drugs include Remicade, Stelara, and Darzalex.

Impact on Individual Investors

The release of JNJ’s Q1 earnings report will have a significant impact on individual investors. The stock price tends to exhibit noticeable volatility following earnings announcements, as investors reassess their expectations for the company’s future profitability and growth prospects. A strong earnings report can lead to an increase in the stock price, while a weak report may result in a decline.

- Positive earnings surprise: If JNJ beats analysts’ earnings estimates, the stock price may experience a short-term boost, as investors become more optimistic about the company’s prospects.

- Negative earnings surprise: Conversely, if the company underperforms analysts’ expectations, the stock price may experience a short-term decline, as investors reassess their view of JNJ’s future profitability.

Impact on the Global Market

Beyond individual investors, JNJ’s earnings announcement will also influence the broader market. As a bellwether company in the healthcare sector, JNJ’s financial performance can provide valuable insights into the industry’s overall health and trends. A strong earnings report from JNJ may lead to increased investor confidence in the sector, potentially driving up the prices of other healthcare stocks.

Analysts’ Expectations

According to a consensus of analysts’ estimates compiled by Yahoo Finance, JNJ is expected to report earnings per share (EPS) of $2.23 for the first quarter, representing a 4.4% increase from the same period last year. The company’s revenue is projected to be $22.03 billion, a 5.2% year-over-year increase. Meeting or exceeding these expectations could lead to a positive reaction from the market.

Conclusion

As Johnson & Johnson prepares to release its Q1 earnings report on April 15, investors and market observers will closely watch the company’s financial performance. A strong earnings report could lead to increased investor confidence in JNJ and the healthcare sector, potentially driving up stock prices. Conversely, a weak report may lead to a decline in the stock price and a loss of investor confidence. Regardless of the outcome, JNJ’s earnings announcement is sure to provide valuable insights into the current state of the healthcare industry and the broader market.

Stay tuned for further analysis and updates as more information becomes available following the earnings release.