World Liberty Financial’s Latest Crypto Acquisition: Sei (SEI)

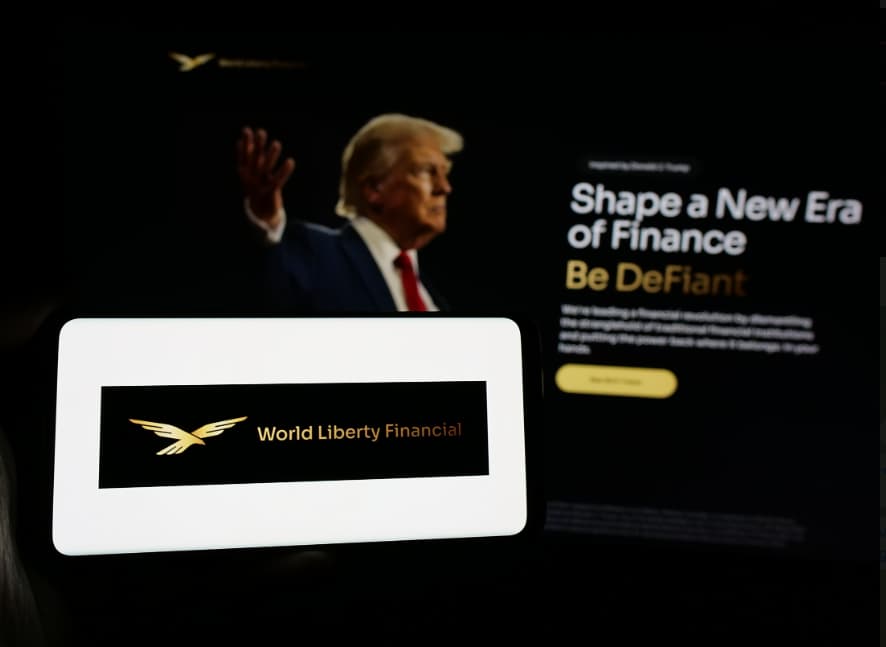

In the ever-evolving world of decentralized finance (DeFi), news of significant acquisitions and partnerships frequently make headlines. One such recent development comes from World Liberty Financial (WLFI), a platform that has reportedly gained the backing of former U.S. President Donald Trump. WLFI has announced its latest addition to its crypto holdings: Sei (SEI).

About Sei (SEI)

Sei is an Ethereum-based decentralized finance protocol designed to provide users with an easy-to-use, yield-bearing stablecoin, SEI, which is pegged to the U.S. dollar. The project aims to provide a stable store of value and a reliable medium of exchange for users in the DeFi ecosystem. Sei’s yield farming model incentivizes users to provide liquidity to the platform, earning them rewards in the form of SEI tokens.

WLFI’s Rationale for Adding Sei (SEI) to Its Portfolio

According to WLFI’s official statement, the addition of Sei to their portfolio is a strategic move aimed at enhancing the platform’s stability and liquidity. The team at WLFI believes that Sei’s stablecoin and yield farming model will complement their existing offerings, providing more value to their users. Moreover, the partnership could potentially attract more users to the WLFI platform, further increasing its adoption and usage.

Impact on Individuals

For individuals interested in DeFi and the crypto space, the addition of Sei to WLFI’s portfolio may present several opportunities. Users of the WLFI platform could potentially benefit from the added liquidity and stability provided by Sei. Additionally, users who are interested in yield farming may find the Sei protocol appealing due to its easy-to-use model and potential rewards in the form of SEI tokens. However, it is essential to remember that investing in crypto and DeFi projects carries inherent risks, and individuals should always do their due diligence before making any investment decisions.

Impact on the World

The addition of Sei to WLFI’s portfolio could have broader implications for the DeFi and crypto space as a whole. The partnership could lead to increased adoption and usage of both the WLFI and Sei platforms, potentially driving up the value of their respective tokens. Moreover, the collaboration could serve as a catalyst for further partnerships and collaborations within the DeFi ecosystem, further fueling the growth and innovation in this space. However, it is essential to note that the DeFi market is highly volatile and subject to significant price fluctuations, making it a risky investment for those unfamiliar with the space.

Conclusion

In conclusion, the addition of Sei (SEI) to World Liberty Financial (WLFI)’s crypto holdings is a strategic move aimed at enhancing the platform’s stability, liquidity, and overall value proposition. The partnership could present opportunities for individuals interested in DeFi and the crypto space, particularly those looking for a stable store of value or yield farming opportunities. However, it is essential to remember that investing in crypto and DeFi projects carries inherent risks, and individuals should always do their due diligence before making any investment decisions. As the DeFi landscape continues to evolve, partnerships and collaborations like this one are likely to shape the future of this exciting and innovative space.

- World Liberty Financial (WLFI) adds Sei (SEI) to its crypto holdings

- Sei is an Ethereum-based stablecoin project with a yield farming model

- The partnership aims to enhance WLFI’s stability and liquidity

- Individuals may benefit from added liquidity and potential yield farming opportunities

- The collaboration could lead to further partnerships and collaborations in the DeFi ecosystem