The Unexpected Collapse of Mantra (OM) in the Crypto Markets: A 65-Minute Implosion

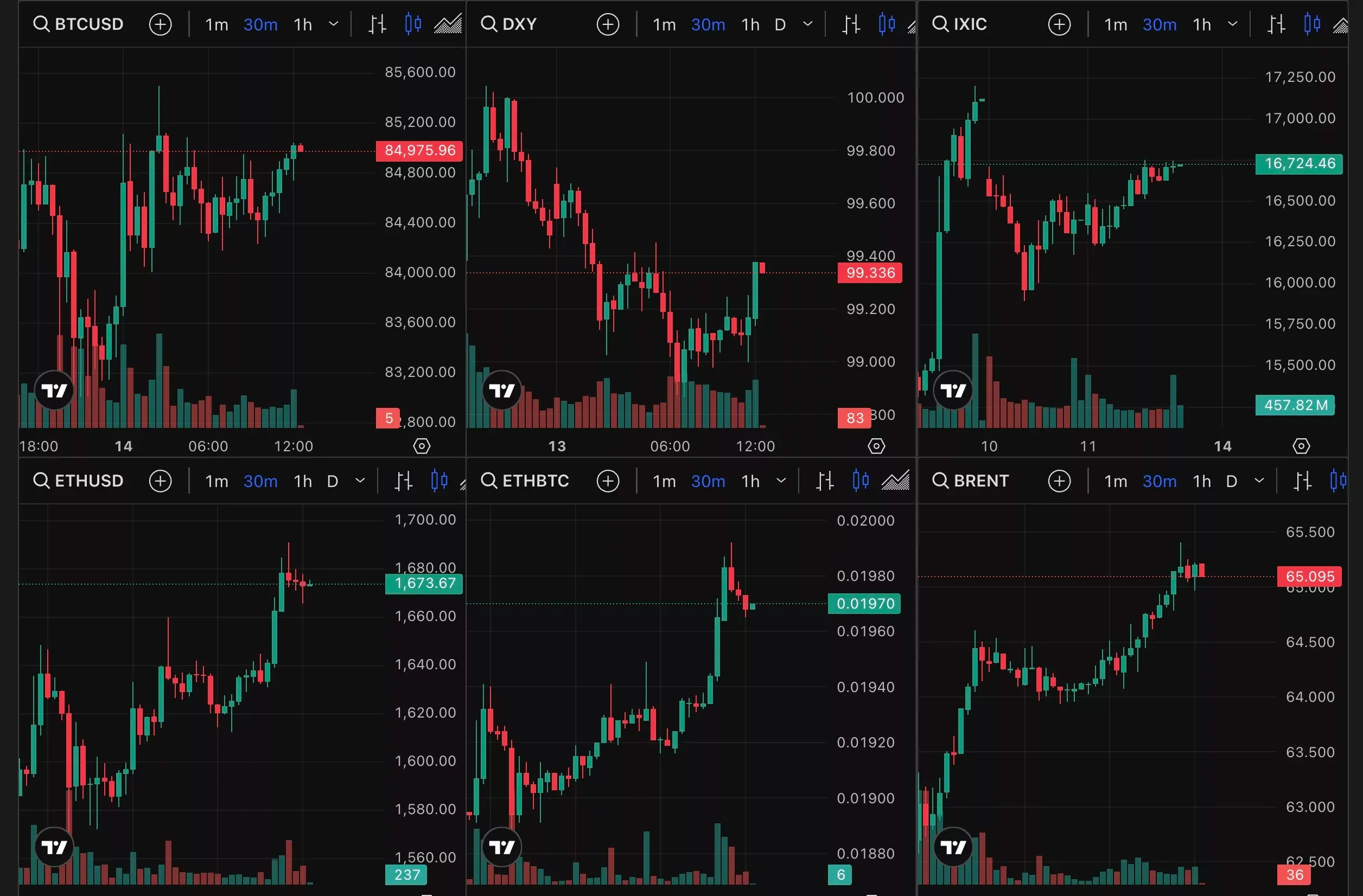

This morning, the crypto markets witnessed yet another shocking event: the sudden and dramatic collapse of Mantra DAO (OM). In a span of merely 65 minutes, the price plummeted from over $6 to an abysmal $0.48. This extreme price volatility left investors reeling and raised concerns about the stability of the decentralized finance (DeFi) sector.

Background and Context

Mantra DAO is a decentralized finance platform that aims to provide decentralized lending, borrowing, and yield farming services. It operates on the Binance Smart Chain and has gained significant attention due to its high yields and low fees. However, like many other DeFi projects, Mantra DAO is not immune to the inherent risks and volatility of the crypto markets.

The Collapse: A Matter of Minutes

The Mantra DAO collapse occurred without any apparent warning signs. According to data from CoinMarketCap, the price of OM began to drop at around 5:30 AM UTC, going from $6.15 to $5.90 within minutes. The downward spiral continued, with the price plummeting to $4.95, $3.80, and eventually $0.48 in just 65 minutes. The actual collapse lasted a mere 40 minutes, with the price dropping from $5.2 to $0.48 in a heart-stopping 25 minutes.

Impact on Individual Investors

The sudden collapse of Mantra DAO resulted in significant losses for individual investors. Those who held large positions in OM saw their investments evaporate in the blink of an eye. Although the DeFi sector is known for its high volatility, such extreme price movements can be devastating for unsuspecting investors. It is essential to exercise caution and due diligence when investing in decentralized finance projects.

Impact on the Global Crypto Community and the DeFi Sector

The collapse of Mantra DAO is likely to have far-reaching consequences for the global crypto community and the decentralized finance sector as a whole. Such extreme price volatility can erode investor confidence and lead to increased regulatory scrutiny. Moreover, it highlights the need for more robust risk management and regulatory frameworks within the DeFi ecosystem.

Additionally, the collapse of Mantra DAO may lead to a ripple effect, with other DeFi projects potentially experiencing similar price volatility. This could result in further losses for investors and potentially harm the reputation of the DeFi sector.

Lessons Learned and Moving Forward

The sudden collapse of Mantra DAO serves as a stark reminder of the inherent risks and volatility of the crypto markets and the decentralized finance sector. It is essential for investors to exercise caution, conduct thorough research, and stay informed about market trends and developments. Additionally, the collapse underscores the need for more robust risk management and regulatory frameworks within the DeFi ecosystem.

Moving forward, it is crucial that the crypto community and the DeFi sector learn from this experience and work towards creating a more stable and secure investment environment. This may involve collaborating with regulators, implementing more stringent risk management measures, and fostering a culture of transparency and accountability within the ecosystem.

- Mantra DAO (OM) collapsed from over $6 to $0.48 in just 65 minutes.

- The extreme price volatility left investors reeling and raised concerns about the stability of the DeFi sector.

- Individual investors suffered significant losses, while the collapse may have far-reaching consequences for the global crypto community and the DeFi sector.

- The need for more robust risk management and regulatory frameworks within the DeFi ecosystem is more apparent than ever.

As the crypto markets continue to evolve, it is essential for investors and stakeholders to remain informed and vigilant. The sudden collapse of Mantra DAO serves as a reminder of the inherent risks and volatility of the sector, but it also presents an opportunity for growth and innovation.