The Impact of Rising Hardware Costs and Potential Government Intervention on U.S. Bitcoin Miners

As the popularity of Bitcoin and other cryptocurrencies continues to soar, so too does the demand for the powerful computers needed to mine them. However, this demand comes with a price. Experts are warning that rising hardware costs could squeeze U.S. miners, making it more difficult for them to turn a profit.

The Squeeze on U.S. Miners

The process of mining Bitcoin involves using complex mathematical algorithms to validate transactions on the blockchain. This process requires significant computational power, which is provided by specialized hardware called Application-Specific Integrated Circuits (ASICs).

However, as more miners enter the market and competition increases, the demand for these ASICs has driven up their prices. For smaller miners, this can make it difficult to compete with larger operations that can afford to buy in bulk and operate at scale.

Government Intervention: A Double-Edged Sword

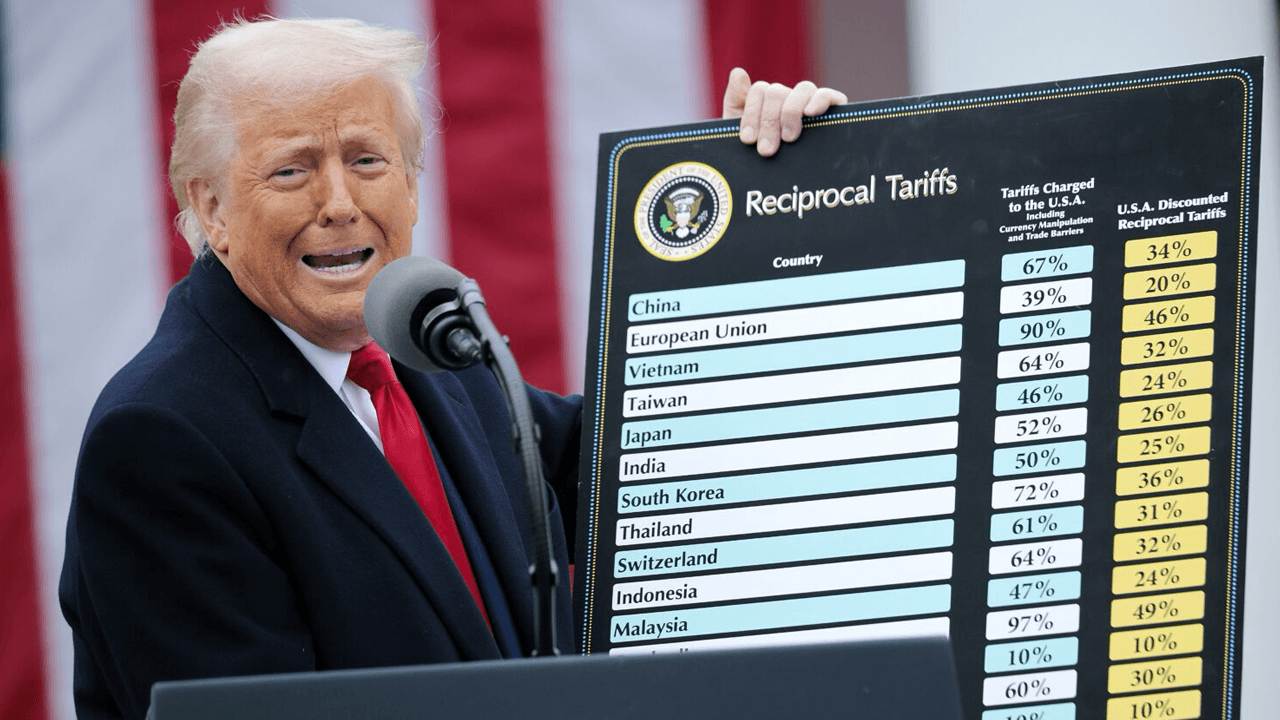

Meanwhile, some speculate that the U.S. government may use new tariff revenues to acquire Bitcoin. This could potentially benefit miners, as it would increase demand for Bitcoin and drive up its price.

However, the government’s involvement in Bitcoin could also have negative consequences. Some fear that government ownership of Bitcoin could lead to increased regulation and potential restrictions on its use.

Personal Impact

For individual investors and miners, the rising costs of hardware and potential government intervention could mean higher costs and increased risk. It may also make it more difficult for smaller miners to compete, potentially leading to consolidation in the industry.

- Higher hardware costs could make it more difficult for smaller miners to turn a profit

- Government involvement in Bitcoin could lead to increased regulation and restrictions

- Consolidation in the industry could lead to fewer opportunities for smaller players

Global Impact

The impact of rising hardware costs and potential government intervention on U.S. miners could have far-reaching consequences. For one, it could shift the balance of power in the industry towards larger players, potentially leading to a more centralized Bitcoin network.

Furthermore, if the U.S. government does acquire Bitcoin, it could set a precedent for other governments to follow suit. This could lead to a significant increase in government ownership of Bitcoin and other cryptocurrencies, potentially undermining their decentralized nature.

- Shift towards a more centralized Bitcoin network

- Increased government ownership of Bitcoin could undermine its decentralized nature

- Potential for increased regulation and restrictions on cryptocurrencies

Conclusion

The rising costs of hardware and potential government intervention are just two of the many challenges facing the Bitcoin mining industry. While these developments could present opportunities for some, they also come with significant risks. As the industry continues to evolve, it will be important for miners and investors to stay informed and adapt to these changes.

Ultimately, the future of Bitcoin and other cryptocurrencies will depend on a complex interplay of technological, economic, and political factors. While it’s impossible to predict exactly how these factors will play out, one thing is certain: the road ahead will be filled with twists and turns.

So, buckle up and get ready for the ride!