Exploring the Impact of Advanced Micro Devices (AMD) Stock Sell-off on Individuals and the World

Advanced Micro Devices (AMD), a leading chipmaker, has experienced a significant stock sell-off in the past year, with shares down approximately 40% as of this writing. Despite the revenue growth AMD has seen in the artificial intelligence (AI) sector, the market has shown reluctance to fully embrace the company’s potential.

Impact on Individuals

For individual investors, the AMD sell-off may present an opportunity to buy shares at a discounted price. However, it is essential to conduct thorough research and consider the company’s financial health, competitive landscape, and future growth prospects before making investment decisions. It is also crucial to remember that investing always carries risk, and past performance is not a guarantee of future results.

Impact on the World

On a larger scale, the AMD sell-off could have implications for the technology industry and the world at large. The decline in AMD’s stock price may affect the company’s ability to attract investors and secure funding for research and development. Furthermore, a less financially stable AMD could limit its ability to compete with industry giants, such as Intel and Nvidia, in the rapidly evolving AI market.

However, it is important to note that the stock market is not the only indicator of a company’s success or potential. AMD’s strong revenue growth in the AI sector suggests that the company is making significant strides in this area, which could lead to future opportunities and innovations. Moreover, the sell-off may be a temporary market response, and the stock price could rebound as investor sentiment shifts.

The Future of AMD and AI

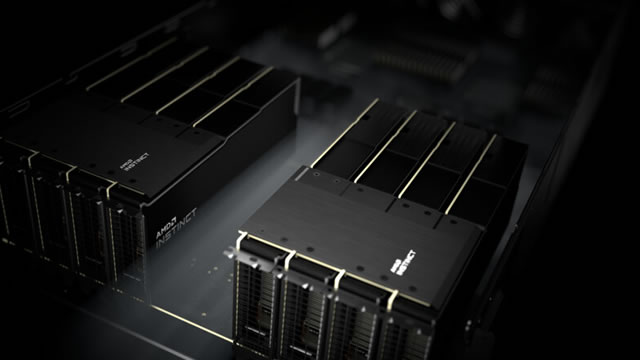

Despite the recent stock sell-off, AMD remains a major player in the AI sector. The company’s CPUs and GPUs are used in data centers and supercomputers around the world, powering various AI applications, from machine learning to deep learning. AMD’s Ryzen and EPYC processors have gained popularity among AI researchers and developers due to their high performance and cost-effectiveness.

Moreover, AMD has been investing heavily in R&D to enhance its offerings in the AI market. For instance, the company has announced its new Instinct MI250X accelerator, which is designed to deliver high-performance AI training and inference capabilities. AMD also plans to launch its next-generation Radeon Instinct MI75 and MI100 GPUs, which are expected to offer significant improvements in AI performance.

- Strengthened partnerships: AMD has formed strategic partnerships with leading AI companies, such as Microsoft, Baidu, and Alibaba, to expand its reach in the AI market.

- Acquisitions: AMD has made several acquisitions to bolster its AI capabilities, including the purchase of Xilinx, a leading provider of adaptive computing platforms.

- Open-source initiatives: AMD supports open-source AI frameworks, such as TensorFlow, PyTorch, and OpenCL, which can help attract developers and researchers to its ecosystem.

In conclusion, the recent AMD stock sell-off presents both challenges and opportunities. For individual investors, it may offer a chance to buy shares at a discounted price. For the technology industry and the world, it could impact AMD’s ability to compete in the AI market and attract funding. However, AMD’s strong revenue growth and ongoing investments in R&D suggest that the company is well-positioned to capitalize on the growing demand for AI solutions.

As the AI market continues to evolve, it is essential to keep an eye on AMD’s progress and the broader market trends. By staying informed and conducting thorough research, investors can make informed decisions and potentially benefit from the company’s growth in the AI sector.