The “War on Digital Assets” in the U.S.: A New Era for Crypto Industry

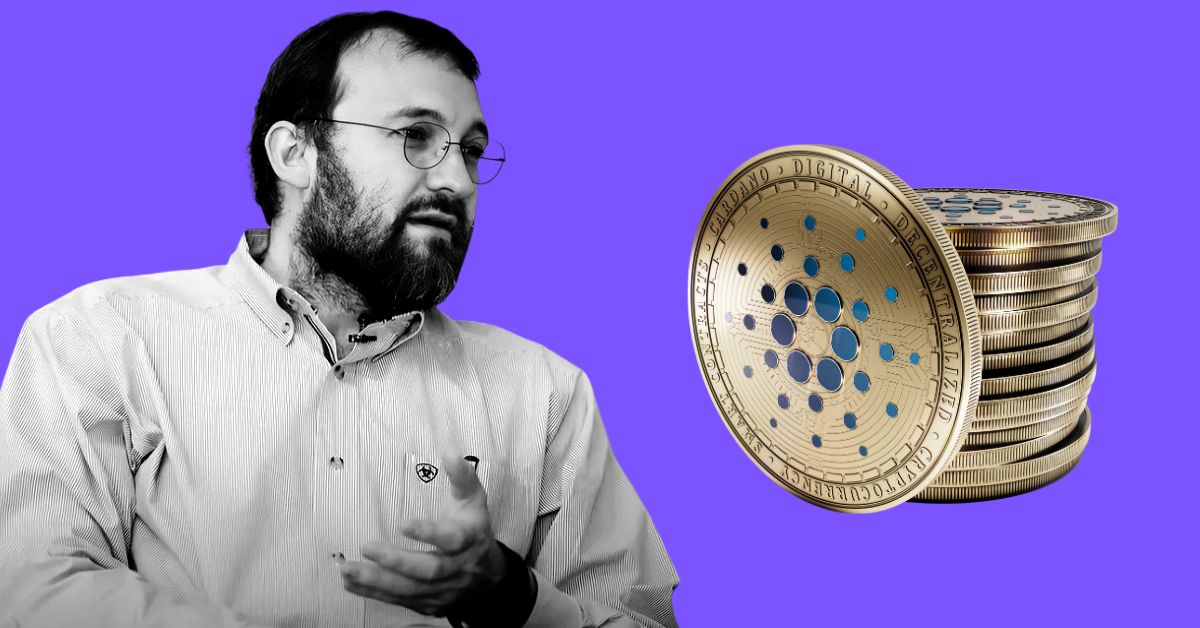

In a groundbreaking announcement, Charles Hoskinson, the visionary co-founder of the Cardano blockchain, declared that the “war on digital assets” in the United States has officially come to an end. This powerful statement comes after years of intense regulatory scrutiny on the crypto industry, with government agencies like the Securities and Exchange Commission (SEC) launching numerous lawsuits and investigations against major cryptocurrency firms.

Background: The Long-lasting Battle

The crypto industry has long been under the microscope of regulatory bodies, especially in the U.S. The SEC, in particular, has been a formidable opponent, labeling various digital assets as securities and pursuing legal action against companies involved in their issuance or trading. Some of the high-profile cases include the legal battle between Ripple Labs and the SEC, which is still ongoing, and the charges against Kik Interactive for conducting an unregistered securities offering.

The Tide Turns: A New Era

Despite these challenges, the crypto industry continued to thrive and innovate. Hoskinson’s announcement marks a significant turning point in the U.S. regulatory landscape for digital assets. The co-founder of Cardano, a proof-of-stake blockchain platform, made these remarks during an interview at the Consensus 2023 conference, expressing his optimism about the future of the industry.

Impact on Individuals

For individuals, this shift in regulatory stance could lead to increased confidence and adoption of digital assets. As regulatory clarity emerges, investors and users may feel more comfortable engaging with cryptocurrencies, leading to a potential surge in demand and usage.

- Increased investor confidence: With clearer regulations, investors may be more likely to invest in digital assets, leading to increased demand and potentially higher prices.

- Greater adoption: As individuals become more comfortable with digital assets, we could see increased usage in everyday transactions and more widespread adoption in various industries.

- Regulatory compliance: Clearer regulations will help ensure that digital asset platforms and companies operate in a compliant manner, providing a safer environment for users.

Impact on the World

The end of the “war on digital assets” in the U.S. could have far-reaching implications for the global economy and financial systems. As the U.S. takes a more welcoming stance on digital assets, other countries may follow suit, leading to a more unified global regulatory framework.

- Global regulatory alignment: With the U.S. taking a more favorable stance on digital assets, other countries may follow suit, leading to a more unified global regulatory framework.

- Increased global adoption: Clearer regulations in the U.S. could lead to increased adoption of digital assets worldwide, as investors and users gain confidence in the technology.

- Innovation and development: A more favorable regulatory environment could lead to an explosion of innovation and development in the digital asset space, with new projects and applications emerging.

Conclusion: A New Chapter

Charles Hoskinson’s announcement that the “war on digital assets” in the U.S. has ended marks a significant milestone in the history of the crypto industry. This new chapter could lead to increased confidence and adoption of digital assets among individuals and businesses, as well as a more unified global regulatory framework. As we move forward, it will be fascinating to see how the crypto industry continues to evolve and shape the future of finance and technology. Stay tuned for more updates on this developing story.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research and consult with a financial professional before making investment decisions.