Good Morning Traders!

Welcome to another exciting day in the world of trading! In today’s Market Clubhouse Morning Memo, we will delve deeper into the current market trends and discuss seven key stocks: SPY, QQQ, AAPL, MSFT, NVDA, GOOGL, META, and TSLA.

SPY:

The S&P 500 ETF (SPY) has been on a rollercoaster ride lately, with increasing volatility due to global economic concerns. According to recent reports, the S&P 500 ended the previous week with a slight gain. Although the index has managed to recover some ground after a sharp sell-off, investors remain cautious due to the ongoing trade tensions and uncertainty surrounding the Federal Reserve’s monetary policy.

QQQ:

The NASDAQ 100 ETF (QQQ) has been a popular choice for tech-focused investors, thanks to the strong performance of its tech holdings. Despite some recent weakness, the QQQ remains a favorite among growth-oriented traders. Key holdings such as Apple, Microsoft, and Tesla have shown resilience in the face of market volatility. However, potential investors should be aware of the sector’s dependence on a few large-cap stocks, which could impact the overall performance of the ETF.

AAPL:

Apple Inc. (AAPL) continues to be a market heavyweight, with a strong focus on innovation and product development. The tech giant’s recent earnings report showed impressive growth in both the iPhone and services segments. However, concerns over the ongoing trade tensions and supply chain disruptions could impact the company’s ability to meet demand for its latest products. Traders should keep an eye on Apple’s stock price movements and earnings guidance for future opportunities.

MSFT:

Microsoft Corporation (MSFT) has been a consistent performer in the tech sector, with a diversified portfolio of products and services. The company’s recent earnings report demonstrated strong growth in its cloud services segment, which could bode well for future revenue growth. However, investors should be aware of the intense competition in the tech sector and potential regulatory challenges that could impact Microsoft’s business.

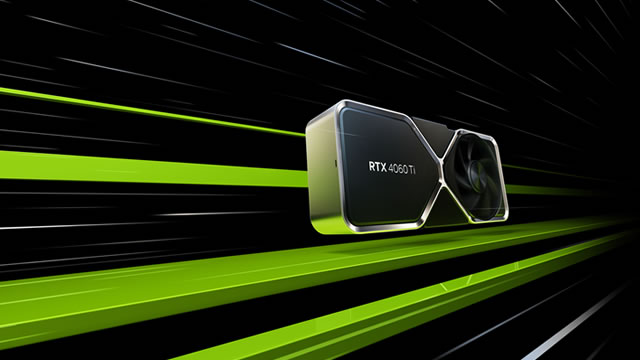

NVDA:

NVIDIA Corporation (NVDA) has been a standout performer in the tech sector, thanks to its leadership in the graphics processing unit (GPU) market. The company’s recent earnings report showed impressive growth in its gaming and data center segments, driven by the increasing demand for GPUs in artificial intelligence and machine learning applications. Traders should keep an eye on NVDA’s stock price movements and potential regulatory challenges in the gaming industry.

GOOGL:

Alphabet Inc. (GOOGL) and its subsidiary Google have been a dominant force in the tech industry, with a diverse range of products and services. The company’s recent earnings report showed strong growth in its advertising segment, driven by the increasing use of digital advertising. However, investors should be aware of the potential regulatory challenges and antitrust concerns that could impact Google’s business.

META:

Meta Platforms Inc. (META), formerly known as Facebook, has been under pressure due to regulatory scrutiny and growing concerns over privacy and data security. The company’s recent earnings report showed a decline in user growth and revenue growth, which could impact its stock price. Traders should keep an eye on Meta’s ability to address these challenges and adapt to the evolving regulatory landscape.

TSLA:

Tesla Inc. (TSLA) has been a market darling, with a strong focus on innovation and disruption in the automotive industry. The company’s recent earnings report showed impressive growth in vehicle deliveries and production, driven by the increasing demand for electric vehicles. However, investors should be aware of the potential regulatory challenges and production issues that could impact Tesla’s business.

Impact on Individuals:

For individual investors, the performance of these stocks could have a significant impact on their portfolios. Depending on their investment goals and risk tolerance, traders may choose to invest in one or more of these stocks based on their fundamental and technical analysis. It’s important for investors to diversify their portfolios and stay informed about the latest market trends and company news.

Impact on the World:

The performance of these stocks could also have a ripple effect on the global economy. For instance, a strong performance by tech stocks could boost consumer confidence and drive economic growth. On the other hand, a weak performance could lead to market volatility and uncertainty, potentially impacting investor sentiment and business confidence. It’s important for policymakers and regulators to stay informed about the latest market trends and take appropriate measures to mitigate potential risks.

In conclusion, the performance of SPY, QQQ, AAPL, MSFT, NVDA, GOOGL, META, and TSLA could have a significant impact on individual investors and the global economy. Traders should stay informed about the latest market trends and company news, and diversify their portfolios to mitigate potential risks. As always, it’s important to consult with a financial advisor before making any investment decisions.