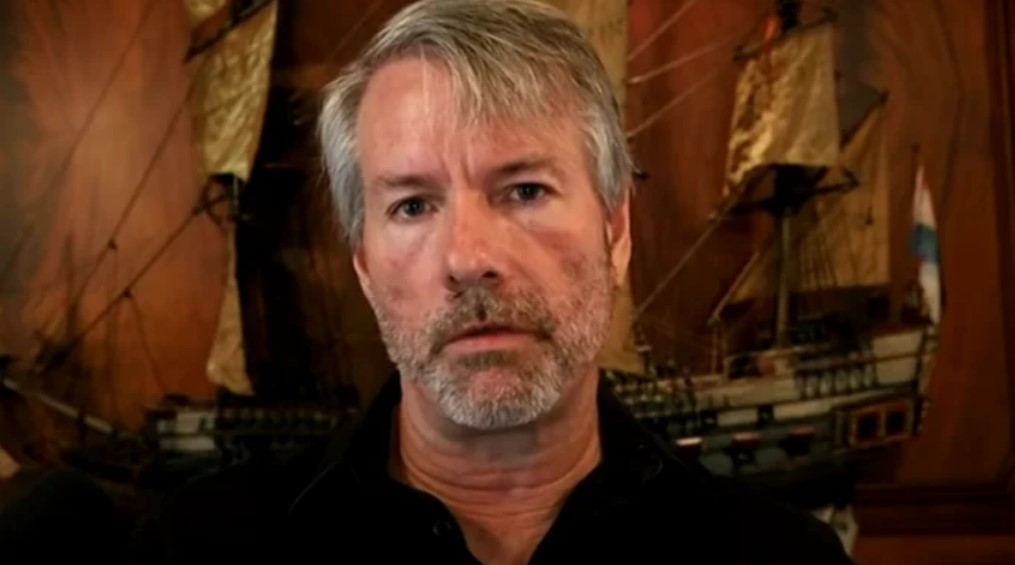

Jason Calacanis Warns of Michael Saylor’s Aggressive Bitcoin Accumulation: Centralization and Long-term Sustainability Concerns

Prominent angel investor and podcast host, Jason Calacanis, has raised concerns over Michael Saylor’s relentless Bitcoin (BTC) accumulation, arguing that the MicroStrategy co-founder’s aggressive strategies could ultimately break the Bitcoin ecosystem. In a series of tweets, Calacanis accused Saylor of centralizing the leading cryptocurrency and damaging its long-term sustainability.

Saylor’s Bitcoin Acquisition: A Centralizing Trend

Calacanis’ concerns stem from the fact that Saylor’s MicroStrategy has been purchasing Bitcoin in large quantities, amassing a total of over 129,000 BTC as of February 2023. This accumulation represents a significant portion of the total Bitcoin supply, and Calacanis argues that it could lead to a centralization of the cryptocurrency.

Debt-driven Strategies: A Potential Threat to Bitcoin

Adding to his concerns, Calacanis pointed to Saylor’s debt-driven strategies, which involve using corporate debt to finance Bitcoin purchases. He argued that this could put undue pressure on the Bitcoin market and potentially lead to a bubble, as the value of the cryptocurrency could be artificially inflated.

Impact on Individual Investors

For individual investors, the potential centralization of Bitcoin through large-scale accumulation by entities like MicroStrategy could lead to increased volatility in the market. This volatility could make it more difficult for smaller investors to enter and exit positions in the cryptocurrency, potentially leading to losses.

Impact on the World

On a larger scale, the centralization of Bitcoin could have far-reaching implications for the global economy. If a small number of entities come to control a large portion of the Bitcoin supply, it could lead to a concentration of wealth and power. This could potentially create new forms of inequality and instability, particularly in developing countries where Bitcoin adoption is high.

Conclusion

Calacanis’ warnings about Michael Saylor’s Bitcoin accumulation highlight the need for caution and careful consideration in the world of cryptocurrencies. While the potential benefits of decentralized digital currencies are significant, the risks of centralization and market manipulation cannot be ignored. As the cryptocurrency market continues to evolve, it will be important for investors, regulators, and other stakeholders to work together to ensure that the benefits of decentralized currencies are realized while minimizing the risks.

- Prominent angel investor Jason Calacanis has raised concerns over Michael Saylor’s Bitcoin accumulation

- Calacanis argues that Saylor’s strategies could centralize the cryptocurrency and damage its long-term sustainability

- Saylor’s large-scale Bitcoin purchases represent a significant portion of the total Bitcoin supply

- Saylor’s debt-driven strategies could lead to market volatility and potential bubble

- Individual investors could face increased volatility and potential losses

- Centralization of Bitcoin could lead to new forms of inequality and instability