Strategic Bitcoin Reserves: A Giant Leap for Crypto Kind

You’ve probably heard the buzz around MicroStrategy, the business intelligence company, making headlines for its significant Bitcoin (BTC) investments. And you’re right – the game is far from over! With its latest purchase of an astounding 13,245 BTC, MicroStrategy’s total Bitcoin holdings now stand at an impressive 105,085 BTC, which translates to nearly half a million dollars’ worth of the digital gold. Let’s dive deeper into this intriguing story.

MicroStrategy’s Bitcoin Bet

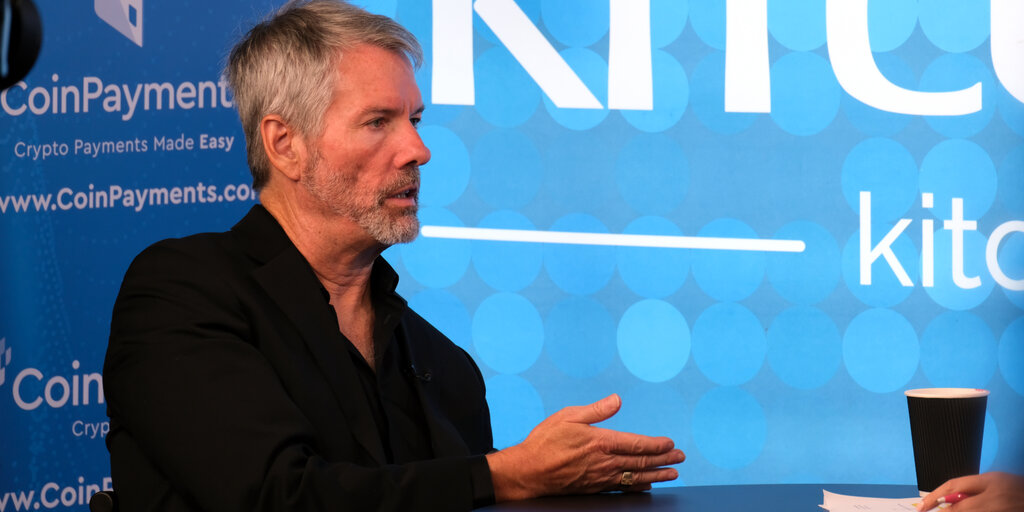

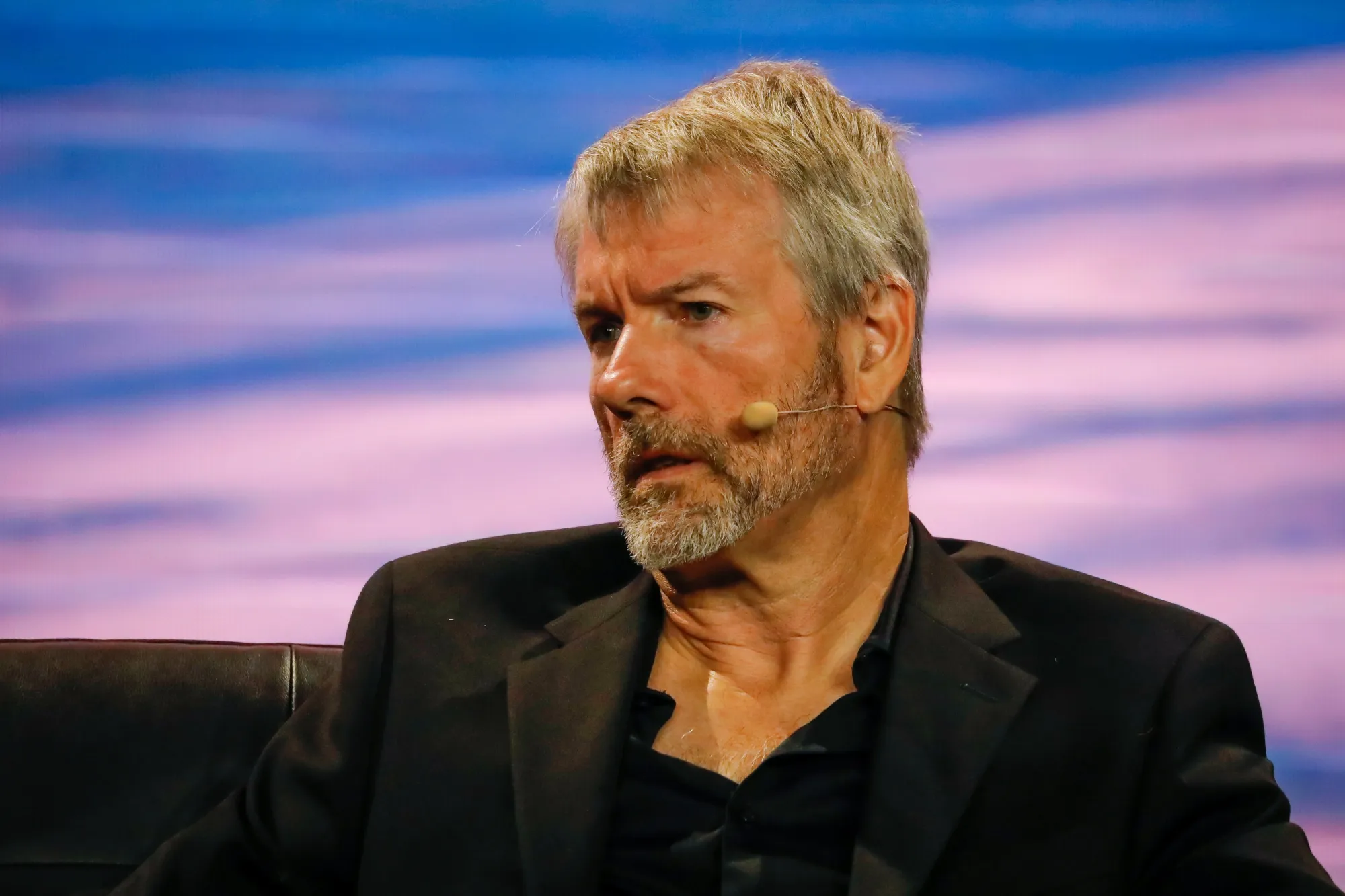

MicroStrategy, led by its charismatic CEO Michael Saylor, began its Bitcoin acquisition spree in August 2020 when it bought a modest 21,454 BTC. Fast forward to today, and the company has more than quadrupled its initial investment, making it the world’s largest corporate Bitcoin holder. This strategic move was made to strengthen the company’s balance sheet and provide a hedge against inflation.

Impact on the Individual

For the average person, MicroStrategy’s Bitcoin buying spree may not seem like a direct concern. However, it’s a clear indication of the growing acceptance and adoption of Bitcoin as a legitimate asset class. This can lead to increased interest and investment in cryptocurrencies, potentially driving up their value and creating new opportunities for individuals to diversify their portfolios. Moreover, as more companies follow suit, the perception of Bitcoin as a volatile, risky investment may shift towards a more stable and valuable asset.

Impact on the World

On a larger scale, MicroStrategy’s Bitcoin investments could significantly impact the global economy. As more corporations and institutions invest in Bitcoin, it could lead to increased demand and, in turn, higher prices. This could potentially disrupt traditional financial institutions and markets, as digital currencies gain more traction and influence. Furthermore, it may encourage governments to reconsider their stance on cryptocurrencies, leading to increased regulation or even adoption.

Conclusion

In conclusion, MicroStrategy’s strategic Bitcoin investments represent a bold step forward in the world of cryptocurrencies. With a growing number of corporations and institutions following suit, Bitcoin’s perception as a volatile, risky investment may soon shift towards a more stable and valuable asset class. This could lead to increased opportunities for individuals to diversify their portfolios and disrupt traditional financial institutions. The future of Bitcoin and its impact on the world remains to be seen, but one thing is for sure – it’s an exciting time to be a part of this digital revolution!

- MicroStrategy, led by CEO Michael Saylor, has purchased over 105,000 Bitcoin, making it the world’s largest corporate Bitcoin holder.

- This strategic move was made to strengthen the company’s balance sheet and provide a hedge against inflation.

- The growing acceptance and adoption of Bitcoin as a legitimate asset class could lead to increased interest and investment in cryptocurrencies.

- MicroStrategy’s Bitcoin investments could significantly impact the global economy by increasing demand and potentially disrupting traditional financial institutions.