The Recent Market Slump: A Closer Look at SUI’s 3.2% Decline

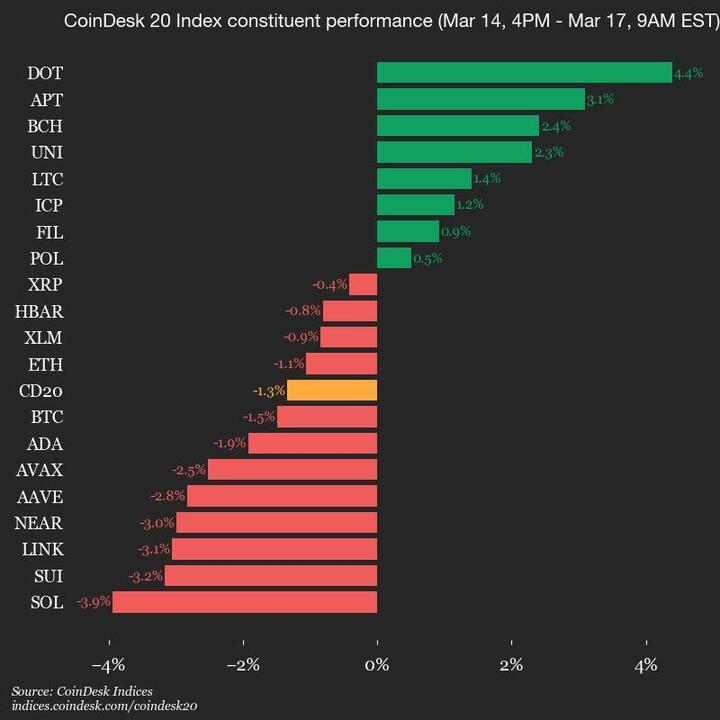

The stock market has been a rollercoaster ride these past few days, with many investors left feeling disoriented and uncertain. Among the underperformers was SUI, which experienced a decline of 3.2% from Friday. This may seem like a small percentage, but it can add up to significant losses for those with large investments.

Understanding SUI’s Performance

To put SUI’s decline into context, it’s important to first understand the factors that contributed to its underperformance. SUI is a technology company that specializes in artificial intelligence and machine learning. While the technology sector has seen its fair share of ups and downs, there are a few key reasons why SUI may have been hit harder than others.

Impact on Individual Investors

For individual investors, a decline in SUI stock can mean lost opportunities for growth. If you’ve held SUI stock for a while, you may be feeling frustrated or even panicked about the future of your investment. It’s important to remember that the stock market is unpredictable, and even the best-performing companies can experience downturns.

- Consider your investment strategy: Are you a long-term investor, or do you trade stocks frequently?

- Diversify your portfolio: Don’t put all your eggs in one basket.

- Stay informed: Keep up with the latest news and trends in the technology sector.

Impact on the World

The decline of SUI is not just an isolated event. It’s part of a larger trend in the technology sector, which has seen many companies experience volatility in recent months. This can have far-reaching consequences, from job losses to economic instability.

- Job losses: A decline in stock prices can lead to job losses, as companies may need to cut costs to stay afloat.

- Economic instability: A volatile stock market can create economic instability, making it harder for businesses to secure funding and investors to make informed decisions.

- Innovation: While a downturn in the stock market can be scary, it can also lead to innovation. Companies may be forced to adapt and find new ways to compete, leading to new technologies and breakthroughs.

Conclusion

The decline of SUI is just one piece of the larger puzzle of the technology sector’s recent volatility. While it can be disheartening to see your investments decline, it’s important to remember that the stock market is unpredictable and that even the best-performing companies can experience downturns. As an individual investor, it’s important to stay informed, diversify your portfolio, and consider your investment strategy. And while the impact of a single company’s decline may seem small, it can have far-reaching consequences, from job losses to economic instability. The key is to stay informed and adapt to the changing market landscape.

Remember, the stock market is just one aspect of the larger economic picture. While it can be tempting to focus on the short-term gains and losses, it’s important to keep a long-term perspective and to stay informed about the latest trends and developments in the technology sector and beyond.