Strategic Bitcoin Accumulation: MicroStrategy’s Continued Investment

MicroStrategy, a leading business intelligence company, has once again made headlines with its strategic Bitcoin (BTC) purchases. The company, which was previously known for its business intelligence and analytics software, has been making waves in the crypto world with its aggressive Bitcoin accumulation.

Background

MicroStrategy first made its entry into the Bitcoin market in August 2020, when it announced that it had purchased 21,454 Bitcoins. This move marked a significant shift for the company, which was previously focused on traditional business intelligence solutions. With this purchase, MicroStrategy became one of the largest publicly-traded companies to hold Bitcoin on its balance sheet.

Recent Purchase

Fast forward to March 2022, and MicroStrategy is at it again. The company announced that it had purchased an additional 480 Bitcoins, bringing its total holdings to over 105,000 Bitcoins. This latest purchase was made at an aggregate purchase price of $10 million.

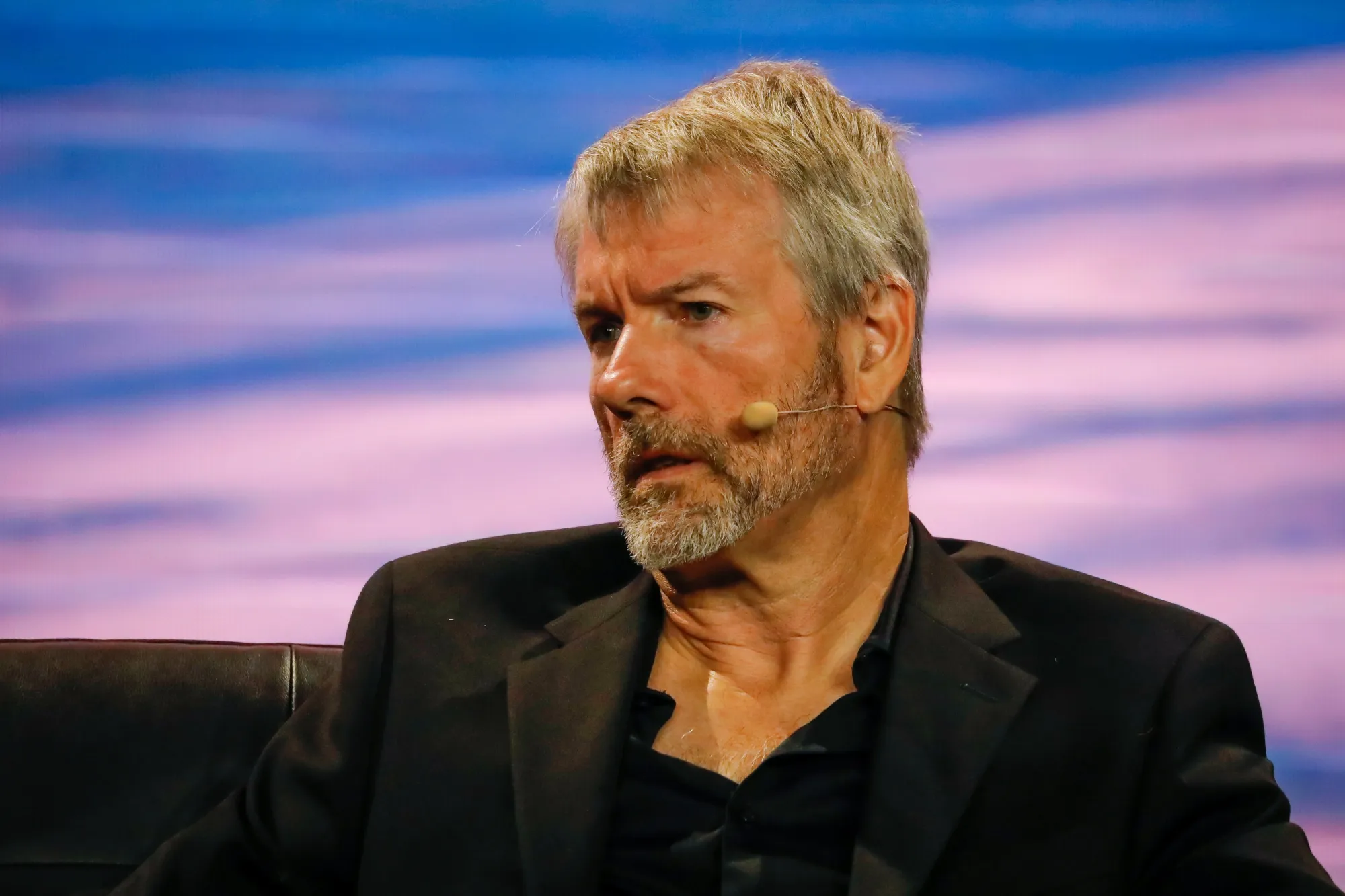

Why Bitcoin?

MicroStrategy’s CEO, Michael Saylor, has been a vocal advocate for Bitcoin and its potential as a store of value. In a statement, he said, “We believe that Bitcoin, as soon as this year, will be an $100 trillion asset class. And so we’re going long, long-term, and we’re not selling.”

Impact on Individuals

For individuals, MicroStrategy’s continued Bitcoin purchases could be a sign of growing institutional adoption and acceptance of Bitcoin as a legitimate asset class. As more companies follow suit and add Bitcoin to their balance sheets, it could lead to increased demand and potentially higher prices. However, it’s important to note that investing in Bitcoin carries risk, and individuals should carefully consider their own risk tolerance and investment goals before making any decisions.

Impact on the World

On a larger scale, MicroStrategy’s Bitcoin purchases could have a significant impact on the world. With over 105,000 Bitcoins, MicroStrategy now holds more Bitcoin than many countries. This massive hoard of Bitcoin could potentially shift the balance of power in the digital currency world and could lead to new opportunities and challenges for governments, financial institutions, and individuals.

Conclusion

MicroStrategy’s continued Bitcoin purchases are a clear indication of the growing acceptance and adoption of Bitcoin as a legitimate asset class. With more companies following suit, we could see increased demand, higher prices, and new opportunities and challenges in the crypto world. However, it’s important for individuals to carefully consider their own risk tolerance and investment goals before making any decisions in this volatile market.

- MicroStrategy, a business intelligence company, has purchased an additional 480 Bitcoins, bringing its total holdings to over 105,000 Bitcoins.

- CEO Michael Saylor believes Bitcoin will be an $100 trillion asset class.

- MicroStrategy’s purchases could lead to increased demand and potentially higher prices.

- Individuals should carefully consider their own risk tolerance and investment goals before making any decisions in the crypto market.