The Dipping Price of Ether: A Detailed Analysis

The cryptocurrency market has been experiencing a rollercoaster ride for the past few months, with Ether (ETH) being no exception. After reaching an all-time high of $4,382 in November 2021, the price of Ether has been on a steady decline. Currently, ETH is trading at around $1,871, a significant drop from its peak.

What Led to the Price Decline?

There are several reasons that have contributed to the decline in Ether’s price. One of the primary factors is the overall bearish sentiment in the cryptocurrency market. The Federal Reserve’s plans to tighten monetary policy and reduce its bond purchases have led to a sell-off in tech stocks and cryptocurrencies. This, in turn, has affected the price of Ether.

Another factor is the increasing competition in the smart contract platform market. Ethereum’s dominance in the space has been challenged by other platforms like Solana, Cardano, and Binance Smart Chain. These platforms offer lower transaction fees and faster confirmation times, making them attractive alternatives for developers and users.

Impact on Individual Investors

For individual investors, the declining price of Ether can be a cause for concern. Those who have invested in Ether at its peak may be experiencing significant losses. However, it’s essential to remember that investing in cryptocurrencies always comes with risk. It’s crucial to do thorough research before making any investment decisions and to diversify your portfolio.

Impact on the World

The decline in Ether’s price can have far-reaching implications for the world. Ethereum is not just a cryptocurrency; it’s also a decentralized platform that enables the creation of decentralized applications (dApps). The price decline can affect the development and adoption of these dApps, as less investment means fewer resources for development.

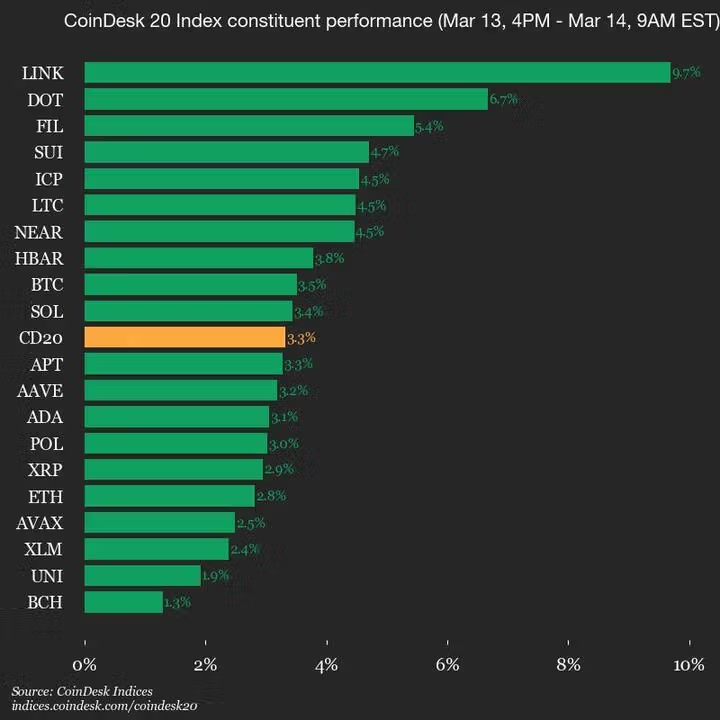

Moreover, Ethereum’s decline can have a ripple effect on other cryptocurrencies. As Ethereum is the second-largest cryptocurrency by market capitalization, its price movements can influence the prices of other cryptocurrencies. This can lead to increased volatility in the market.

Looking Ahead

Despite the current price decline, many experts remain bullish on Ethereum’s long-term prospects. The Ethereum community is continually working on upgrades like Ethereum 2.0, which aims to make the platform more scalable and sustainable. This, coupled with the increasing adoption of decentralized finance (DeFi) applications, could drive the price of Ether up in the future.

- Ethereum’s price has been declining since it fell below the $2,000 mark

- The price drop can be attributed to overall bearish sentiment in the crypto market and increasing competition from other platforms

- Individual investors may experience losses, but it’s essential to remember the risks involved in crypto investing

- The decline in Ethereum’s price can affect the development and adoption of decentralized applications

- Long-term prospects for Ethereum remain positive, with the community working on upgrades and increasing adoption of DeFi applications

In conclusion, the declining price of Ethereum is a cause for concern for both individual investors and the wider world. However, it’s important to remember that cryptocurrencies are inherently risky investments. The long-term prospects for Ethereum remain positive, with ongoing upgrades and increasing adoption of decentralized applications. As always, thorough research and a diversified portfolio are key to navigating the cryptocurrency market.