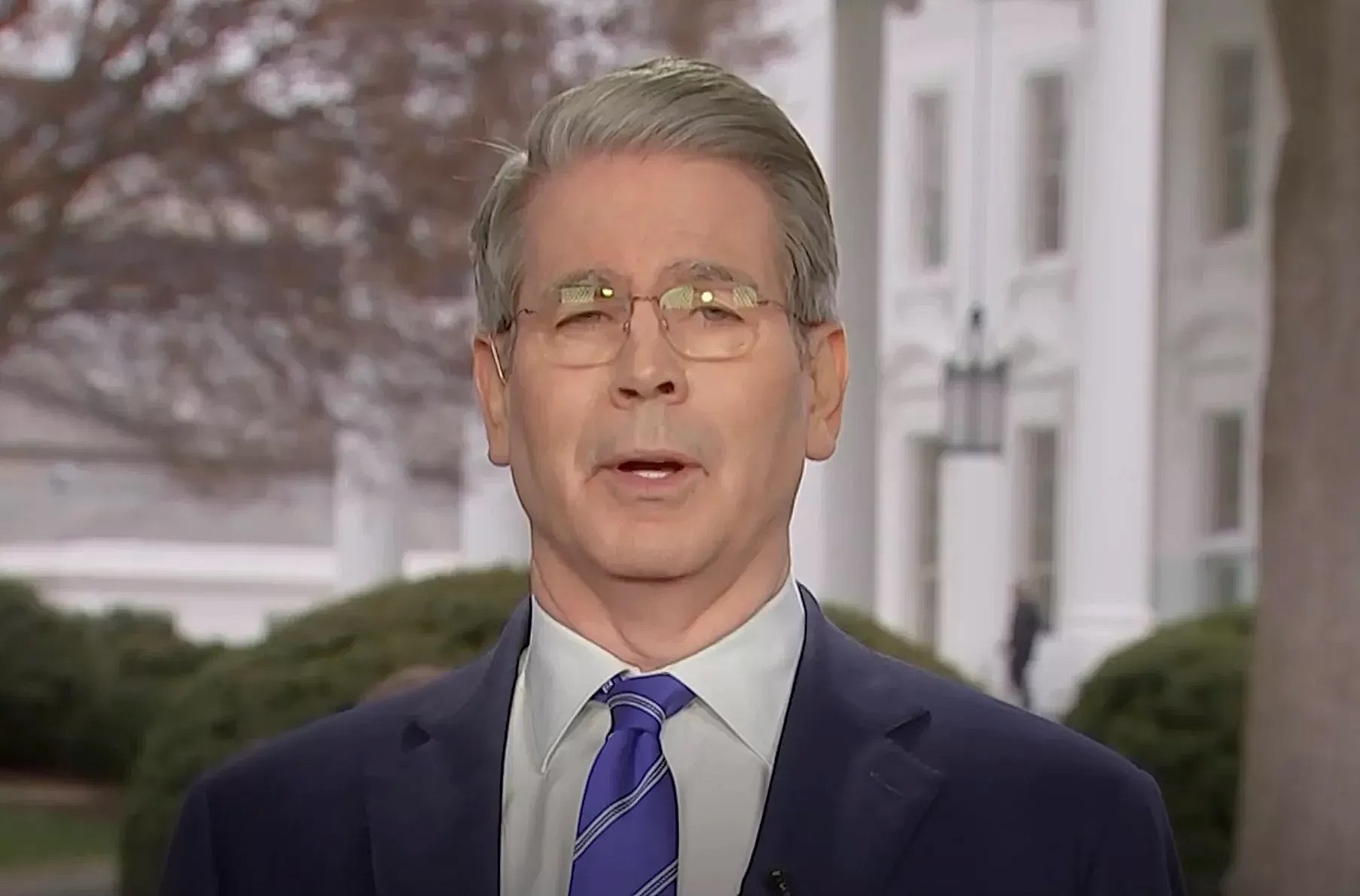

Binance CEO’s Long-Term Bullish Outlook on Bitcoin and Digital Assets

In a recent interview, Binance CEO Richard Teng shared his optimistic view on the future of Bitcoin (BTC) and other digital assets, despite the ongoing market turbulence. Teng, who is also the head of Binance’s global institutional business, expressed his belief that the digital asset industry is still in its early stages and that the current market volatility is a normal part of the growth process.

CEO’s Perspective

According to Teng, the digital asset market is experiencing a period of maturation, with more institutional investors entering the space and regulatory frameworks being established. He also highlighted the increasing use cases for digital assets, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), which he believes will drive long-term growth.

Impact on Individuals

For individuals, Teng’s bullish outlook could mean that now is a good time to consider investing in digital assets, especially if they have a long-term investment horizon. However, it’s important to note that investing in digital assets comes with risks, and individuals should do their own research and consider their own risk tolerance before making any investment decisions.

- Diversify your portfolio: Consider investing in a range of digital assets, rather than just focusing on Bitcoin.

- Stay informed: Keep up-to-date with the latest news and developments in the digital asset industry.

- Secure your investments: Use secure storage solutions, such as hardware wallets, to protect your digital assets.

Impact on the World

On a larger scale, Teng’s bullish outlook on digital assets could have significant implications for the global economy. The decentralized nature of digital assets could disrupt traditional financial systems, making transactions faster, cheaper, and more accessible to people around the world. Additionally, the use of digital assets in industries such as supply chain management and voting systems could lead to increased transparency and efficiency.

- Financial inclusion: Digital assets could provide financial services to the 1.7 billion unbanked and underbanked individuals around the world.

- Efficient transactions: Digital assets could make cross-border transactions faster and cheaper, reducing the need for intermediaries.

- New industries: Digital assets could give rise to new industries, such as DeFi and NFTs.

Conclusion

Despite the ongoing market turbulence, Binance CEO Richard Teng remains long-term bullish on Bitcoin and other digital assets. For individuals, this could mean that now is a good time to consider investing in digital assets, but it’s important to do your own research and consider the risks involved. On a larger scale, the growth of the digital asset industry could have significant implications for the global economy, including increased financial inclusion, more efficient transactions, and the rise of new industries.

As the digital asset industry continues to evolve, it’s important for individuals and businesses to stay informed and adapt to the changing landscape. With the right approach, digital assets could provide new opportunities for growth and innovation.