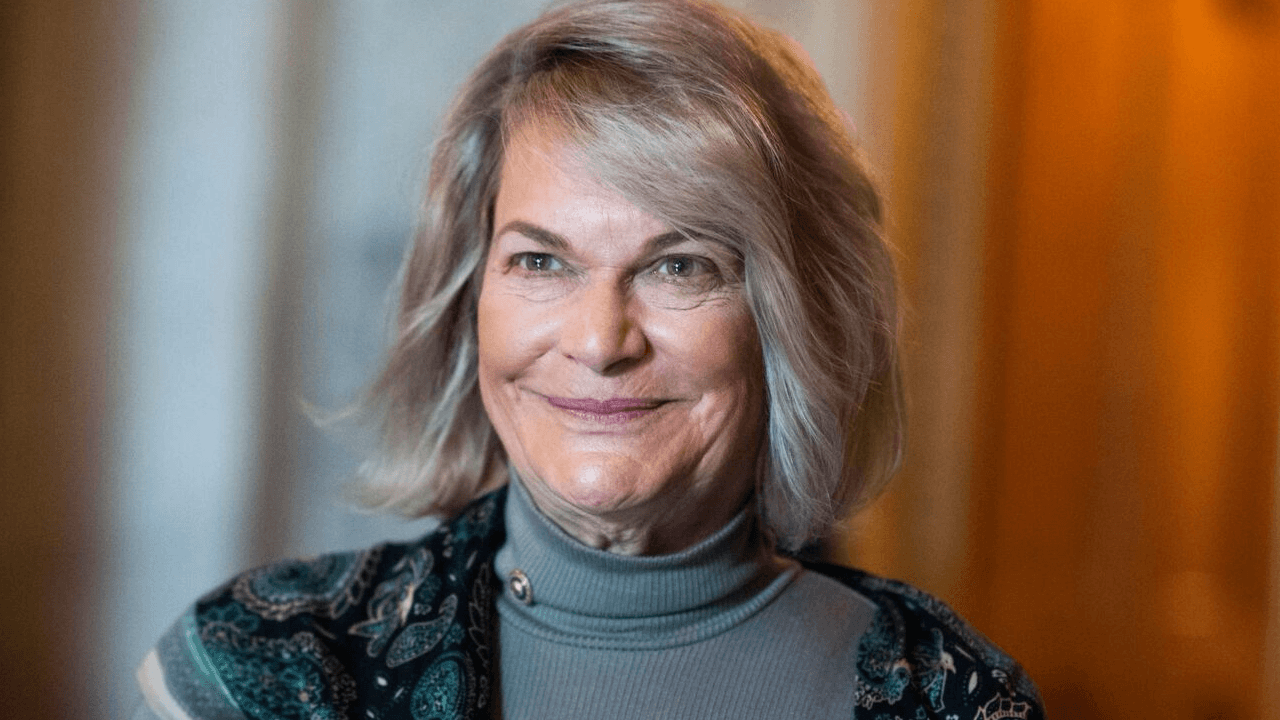

Sen. Cynthia Lummis’ Bitcoin Bill: A New Lease of Life for Digital Gold

In a bold move that could redefine the digital currency landscape, Sen. Cynthia Lummis (R-Wyo.) has reintroduced legislation to establish a U.S. Strategic Bitcoin Reserve. This bill, which aims to transform former President Donald Trump’s executive order into federal law, has left the crypto community buzzing with excitement and intrigue.

A Quick Refresher: Trump’s Executive Order

For those who might have missed it, back in August 2020, President Trump signed an executive order that directed the Secretary of the Treasury to explore the potential use of digital assets for the country’s reserve. This order, while significant, did not go beyond an exploratory phase.

Sen. Lummis’ Proposed Bill

Sen. Lummis’ new bill, however, takes things a step further. It proposes the creation of a Strategic Bitcoin Reserve, which would be used to buy, hold, and secure Bitcoin on behalf of the United States. This reserve would not only serve as a strategic asset but also provide a significant boost to the digital currency’s legitimacy.

Why Bitcoin?

You might be wondering, “Why Bitcoin?” Well, according to Sen. Lummis, Bitcoin’s decentralized nature makes it an attractive option for a strategic reserve. Moreover, she believes that the U.S. should not be left behind in the digital currency race.

Implications for the Average Joe

So, how does this affect you, dear reader? Well, if the bill passes, it could mean that the U.S. government recognizes Bitcoin as a legitimate asset class. This recognition could lead to increased institutional adoption and, in turn, a potential surge in Bitcoin’s price.

- Investors might see Bitcoin as a safer bet, leading to an increase in demand and price.

- Government recognition could also lead to more mainstream acceptance of Bitcoin, making it more accessible to the average Joe.

Impact on the World

Now, let’s talk about the bigger picture. If the U.S. establishes a Strategic Bitcoin Reserve, other countries might follow suit. This could lead to a global race to secure digital assets, potentially creating a new asset class for national reserves.

- A global adoption of digital currencies could lead to increased financial inclusion, as many people in underbanked regions could gain access to digital currencies.

- The creation of a new asset class could lead to increased volatility in the financial markets, as governments try to navigate the complex world of digital currencies.

Conclusion: A New Era for Digital Currencies

In conclusion, Sen. Cynthia Lummis’ proposed Bitcoin bill could mark the beginning of a new era for digital currencies. Whether you’re an average investor or a global powerhouse, the implications of this bill are far-reaching and exciting. So, keep an eye on Capitol Hill, folks. This could be the start of something big!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making investment decisions.

Quirky Side Note:

And on a lighter note, imagine the hilarious headlines if the U.S. had to mine its own Bitcoin: “U.S. Mines First Block in Strategic Bitcoin Reserve: ‘Digging Deep’ Says Sen. Lummis.”