Synopsys (SNPS): A Closer Look at This Highly-Watched Stock

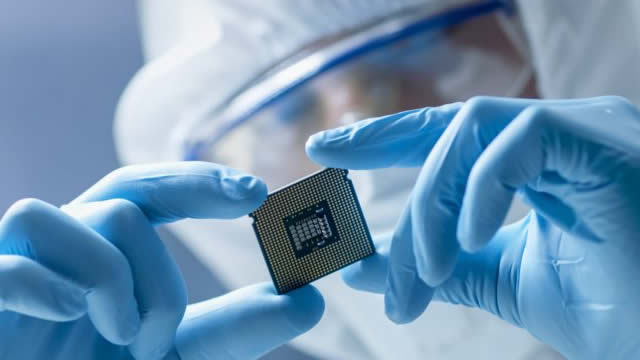

Synopsys, Inc. (SNPS), a leading provider of electronic design automation (EDA) software and intellectual property (IP) for semiconductor and system design, has recently garnered significant attention from Zacks.com users. With the semiconductor industry continuing to evolve at a rapid pace, it’s essential to understand the factors influencing Synopsys’ performance and its potential impact on both individual investors and the global tech landscape.

Company Overview

Founded in 1986, Synopsys is headquartered in Mountain View, California. The company’s software and IP solutions help design, verify, and manufacture electronic components and systems, enabling customers to bring innovative products to market faster. Synopsys’ offerings cater to various industries, including automotive, communications, consumer, industrial, and defense & aerospace.

Financial Performance

In the most recent quarterly report, Synopsys announced strong revenue growth of 19% year-over-year, surpassing analysts’ expectations. The company’s net income also increased by 27% year-over-year, driven by growth in its Design Solutions and IP segments. Synopsys’ continued success can be attributed to its focus on innovation, expanding its offerings, and strategic acquisitions.

Market Trends and Drivers

The semiconductor industry is witnessing a surge in demand due to the increasing adoption of advanced technologies such as 5G, Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). Synopsys is well-positioned to capitalize on these trends, as its solutions are integral to the design and development of these innovative technologies.

Moreover, the ongoing semiconductor shortage has highlighted the importance of efficient design and manufacturing processes. Synopsys’ software and IP solutions enable companies to streamline their design processes, reducing time-to-market and minimizing costs. This competitive advantage is expected to contribute to the company’s continued growth.

Impact on Individuals

For individual investors, Synopsys’ strong financial performance and growth potential make it an attractive investment opportunity. The company’s consistent revenue growth and expanding market opportunities position it for long-term success. Additionally, Synopsys’ focus on innovation and strategic acquisitions demonstrate its commitment to staying at the forefront of the semiconductor industry.

Impact on the World

On a larger scale, Synopsys’ impact on the world can be seen in the advancement of various industries and technologies. The company’s software and IP solutions contribute to the design and development of semiconductors that power devices such as smartphones, computers, automobiles, and industrial machinery. Synopsys’ solutions are also crucial in the development of emerging technologies like 5G, IoT, AI, and ML, which are transforming industries and improving everyday life.

Conclusion

Synopsys’ strong financial performance, innovative offerings, and strategic acquisitions make it a compelling investment opportunity for individuals. Moreover, its contributions to the semiconductor industry and the development of emerging technologies have far-reaching implications for the global tech landscape. As Synopsys continues to innovate and adapt to market trends, it is poised to play a significant role in shaping the future of technology.

- Synopsys is a leading provider of EDA software and IP for semiconductor and system design.

- The company’s strong financial performance and growth potential make it an attractive investment opportunity.

- Synopsys’ solutions are integral to the design and development of semiconductors and emerging technologies.

- The company’s focus on innovation and strategic acquisitions positions it for long-term success.