Stock Markets Rebound as Trump Signals Openness to Tariff Deal

U.S. stock futures experienced a significant rebound early on Wednesday, following a sharp decline the previous day. The Dow Jones Industrial Average and S&P 500 futures climbed up by more than 0.5% and 0.6%, respectively, after dropping to their lowest levels since before the November election. This uptick in market sentiment came after Commerce Secretary Wilbur Ross reported that President Donald Trump was open to the idea of rolling back some of the tariffs currently imposed on neighbors Canada and Mexico.

Background on U.S.-Mexico-Canada Agreement (USMCA)

The USMCA, which replaced the North American Free Trade Agreement (NAFTA), went into effect on July 1, 2020. The agreement aimed to modernize and strengthen the economic relationship between the three countries. However, the implementation of the USMCA was not without challenges, including disagreements over automotive rules and labor standards.

Commerce Secretary Signals Potential Tariff Rollbacks

On Tuesday, Commerce Secretary Howard Lutnick indicated that the U.S. was open to reconsidering some of the tariffs on Canadian and Mexican imports. Lutnick’s comments came during a virtual event hosted by the Canadian American Business Council. He stated, “I think there’s a recognition that these tariffs were put in place for a reason, but they’re not serving their purpose anymore.”

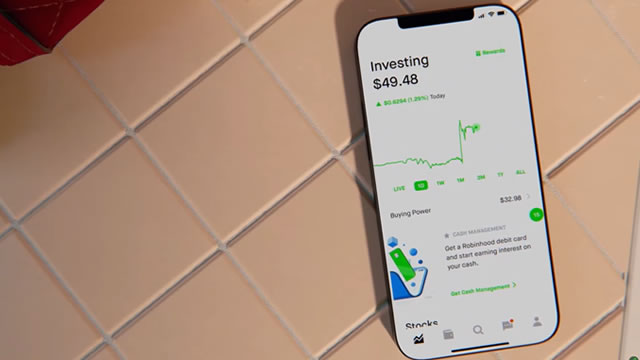

Market Impact

The potential for a tariff rollback between the U.S., Canada, and Mexico led to a wave of optimism in the markets. The rebound in U.S. stock futures was particularly noticeable in sectors that had been negatively affected by the tariffs, such as automakers and agriculture. For example, Ford Motor Company (F) and General Motors Company (GM) stocks saw gains of around 1.5% and 2.5%, respectively.

Global Impact

The potential for a tariff rollback between the U.S., Canada, and Mexico could have significant global implications. The USMCA is a critical trade agreement that accounts for a substantial portion of global economic activity. A reduction in tariffs could lead to increased trade and investment between the three countries, potentially boosting economic growth and job creation.

Conclusion

The early rebound in U.S. stock futures on Wednesday was a positive sign for investors, indicating that the markets may be responding to the potential for a tariff rollback between the U.S., Canada, and Mexico. Commerce Secretary Howard Lutnick’s comments suggesting that President Trump is open to reconsidering some of the tariffs imposed on neighbors Canada and Mexico have brought renewed optimism to the markets. However, it is essential to remember that any potential deal would still need to be negotiated and ratified by all parties involved. As investors, it is crucial to stay informed about developments related to this issue and how it may impact specific sectors and companies in which we have investments.

- U.S. stock futures rebounded on Wednesday after dropping to their lowest levels since before the November election.

- Commerce Secretary Howard Lutnick signaled that President Donald Trump was open to rolling back some of the tariffs on Canadian and Mexican imports.

- The potential for a tariff rollback led to optimism in the markets, particularly in sectors negatively affected by the tariffs.

- A reduction in tariffs could boost economic growth and job creation in the U.S., Canada, and Mexico.

- It is essential to stay informed about developments related to the potential tariff rollback and how it may impact specific sectors and companies.