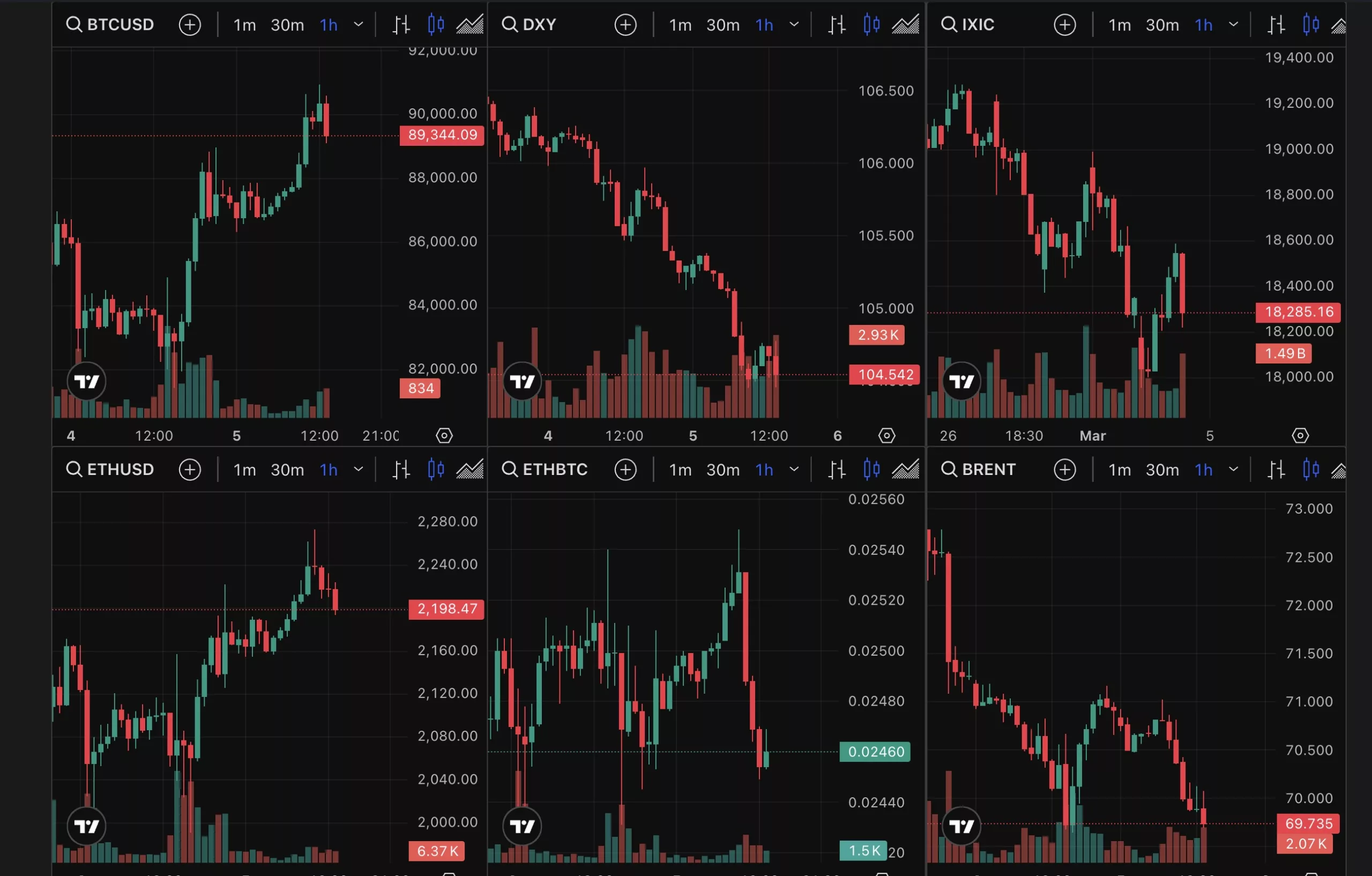

Cryptocurrency Market Dips: A Closer Look

The cryptocurrency market is experiencing a significant downturn today, with most coins bouncing off from their previous highs, according to CoinMarketCap. This trend is not an uncommon occurrence in the volatile world of digital currencies. In this blog post, we’ll delve deeper into the reasons behind this market dip and explore its potential implications for individual investors and the world at large.

Factors Contributing to the Market Dip

Several factors could be contributing to the current market downturn. One potential reason is the ongoing regulatory crackdown on cryptocurrencies in various parts of the world. For instance, China has recently announced a ban on cryptocurrency mining and trading, leading to a sell-off in the market. Additionally, the US Securities and Exchange Commission (SEC) has continued its crackdown on initial coin offerings (ICOs) and other cryptocurrency-related securities.

Another factor that may be contributing to the market dip is the overall economic instability caused by the COVID-19 pandemic. The global economic downturn has led to a decrease in investor confidence, with many opting to hold onto their cash rather than invest in risky assets like cryptocurrencies. Furthermore, the ongoing uncertainty surrounding the pandemic’s future impact on the global economy is also causing market volatility.

Implications for Individual Investors

For individual investors, the current market dip could present both opportunities and risks. On the one hand, it may be an opportunity to buy coins at a lower price, with the hope of selling them at a higher price once the market recovers. On the other hand, there is a risk of further market downturn, which could result in significant losses. It is essential for investors to carefully consider their risk tolerance and investment strategy before making any decisions.

Global Implications

The cryptocurrency market dip could also have far-reaching implications for the world at large. For instance, it could impact the adoption and legitimacy of digital currencies, particularly in regions where they are already facing regulatory challenges. Furthermore, it could also impact the broader financial system, as cryptocurrencies continue to gain popularity as an alternative investment class.

Conclusion

In conclusion, the current cryptocurrency market dip is a reminder of the volatility and risks associated with digital currencies. While it may present opportunities for individual investors, it also highlights the importance of careful consideration and risk management. Additionally, it underscores the ongoing regulatory challenges facing the cryptocurrency industry and the potential impact of economic instability on the market. As always, it is essential to stay informed and cautious when investing in cryptocurrencies.

- Cryptocurrency market experiencing a significant downturn

- Regulatory crackdown in China and US contributing to sell-off

- COVID-19 pandemic and economic instability also impacting market

- Individual investors may see opportunities or risks

- Market downturn could impact adoption and legitimacy of digital currencies

- Regulatory challenges and economic instability ongoing concerns