Binance Open Interest Drops Below 10,000 BTC: What Does It Mean for You and the World of Crypto?

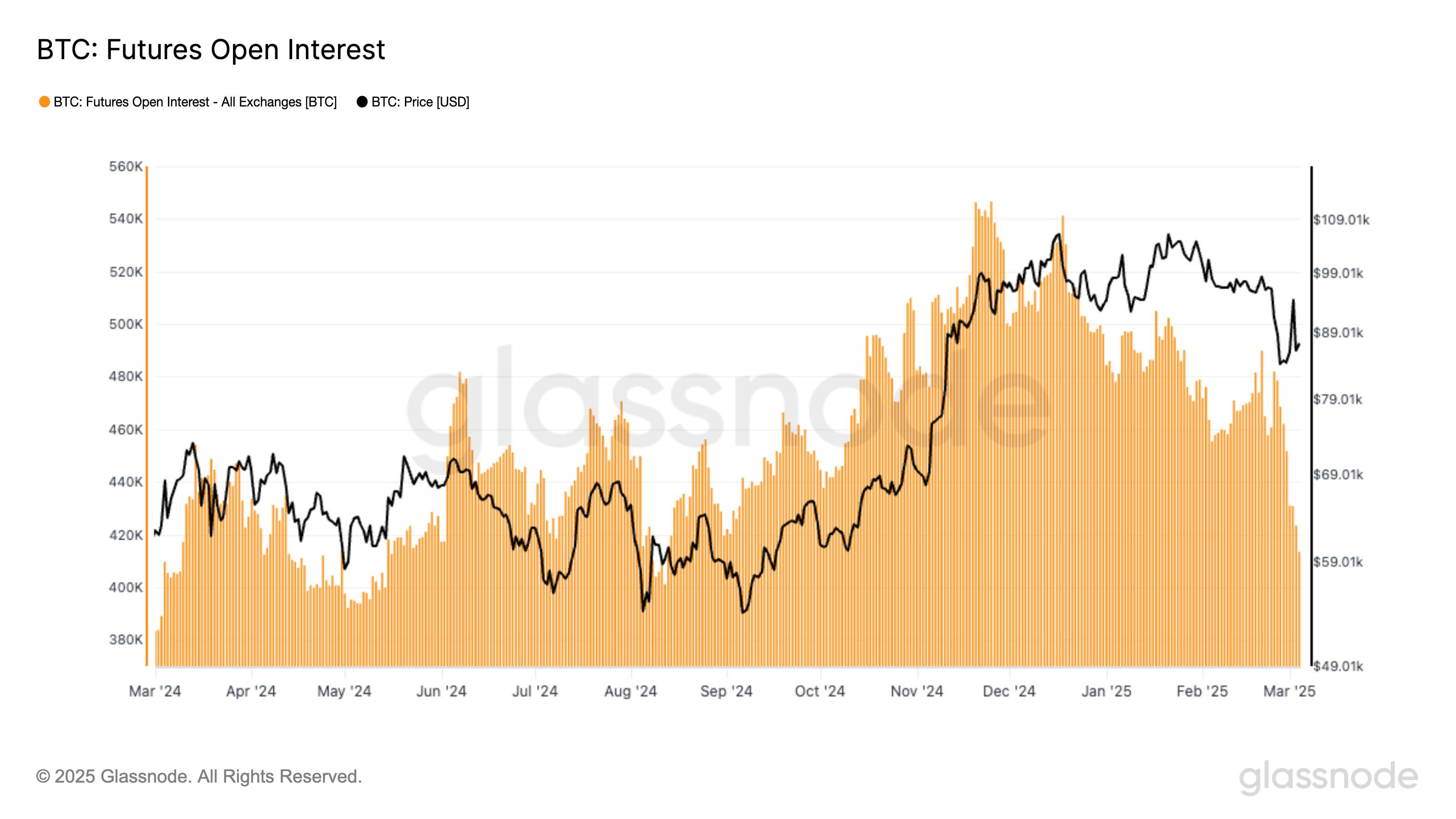

Recently, the crypto community was abuzz with news that Binance, the world’s largest cryptocurrency exchange by trading volume, saw its open interest in Bitcoin (BTC) drop below the 100,000 BTC mark for the first time in over a year. Open interest refers to the total number of outstanding derivative contracts that have not been settled, indicating the level of market activity and liquidity.

Impact on the Individual Investor

Lower open interest: A decrease in open interest could be seen as a bearish sign, as it suggests a lack of confidence in the market and potentially lower trading volumes. However, it’s essential to note that this doesn’t necessarily mean that the price of BTC will drop. Open interest and price are not directly correlated, and other factors, such as market sentiment and fundamental analysis, play a significant role in determining the price.

Opportunities: For the individual investor, a lower open interest could present opportunities for profitable trades. With fewer contracts outstanding, there may be less competition, making it easier to enter and exit positions at desired price points. Additionally, a decrease in open interest could be a sign of a market correction or consolidation, providing an opportunity to buy at lower prices.

Impact on the Crypto Ecosystem

Market maturity: A decrease in open interest on Binance could be seen as a sign of market maturity. As the crypto market evolves, investors may shift away from leveraged trading and derivatives and focus more on buying and holding cryptocurrencies. This shift could lead to more stable market conditions, as the focus moves away from short-term speculation and towards long-term investment.

Regulatory environment: Regulatory uncertainty and increased scrutiny from global regulators have been cited as potential reasons for the decrease in open interest. As governments around the world crack down on cryptocurrency trading and exchanges, investors may be more cautious about entering into derivative contracts. This trend could continue as regulatory clarity emerges, leading to a more stable and regulated market.

Conclusion

The recent drop in Binance’s open interest below 100,000 BTC is a significant development in the crypto market. While it could be seen as a bearish sign, it also presents opportunities for individual investors and signals market maturity. As the regulatory environment continues to evolve, it’s essential for investors to stay informed and adapt to changing market conditions.

- Lower open interest could present opportunities for profitable trades due to less competition.

- Market maturity could lead to more stable market conditions and a shift towards long-term investment.

- Regulatory uncertainty and increased scrutiny from global regulators could be contributing factors to the decrease in open interest.

As always, it’s crucial to do your own research and consult with financial and tax professionals before making any investment decisions. The crypto market is volatile and subject to rapid change, so staying informed and adaptable is key to success.