Navitas Semiconductor: A Week of Significant Sell-offs

Navitas Semiconductor, a leading innovator and manufacturer of gallium nitride (GaN) power semiconductor solutions, experienced a notable decline in its stock price over the last week of trading. According to market intelligence data, the company’s shares closed down 22.7% from the previous week’s closing price.

Impact on Navitas Semiconductor

The recent sell-offs in Navitas Semiconductor’s stock may be attributed to several factors. One significant factor is the overall market trend. The semiconductor industry, and the technology sector as a whole, have been experiencing increased volatility due to various economic and geopolitical concerns. Furthermore, Navitas Semiconductor’s financial results for the latest quarter did not meet the expectations of some investors.

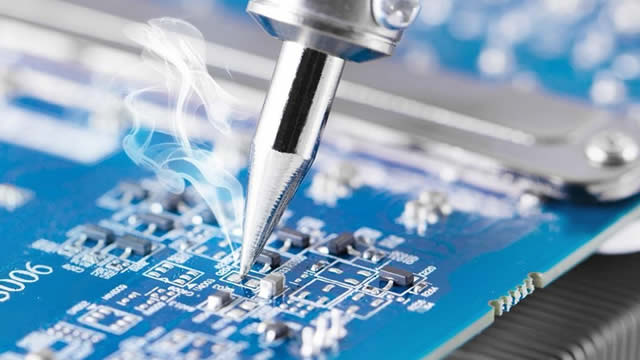

Despite these challenges, Navitas Semiconductor remains a promising player in the semiconductor industry. The company’s GaN-on-silicon power semiconductors offer significant advantages over traditional silicon-based solutions, including higher efficiency, smaller size, and lower heat generation. Navitas Semiconductor’s technology is gaining traction in various markets, including automotive, industrial, and renewable energy.

Impact on Individuals

For individual investors, the sell-offs in Navitas Semiconductor’s stock may present both opportunities and risks. On the one hand, the stock’s decline could represent a buying opportunity for those who believe in the long-term potential of the company and its technology. On the other hand, investors who have recently purchased Navitas Semiconductor shares may experience losses if they choose to sell at the current price.

Impact on the World

Navitas Semiconductor’s technological innovations have the potential to make a significant impact on the world. The company’s GaN-on-silicon power semiconductors can contribute to more energy-efficient and smaller electronic devices, which is essential for reducing carbon emissions and addressing climate change. Additionally, these semiconductors can improve the performance and reliability of various industrial and automotive applications, leading to increased productivity and safety.

Despite these potential benefits, the sell-offs in Navitas Semiconductor’s stock may have negative consequences. The decline in the company’s stock price could deter investors from investing in the semiconductor industry or GaN technology specifically. Moreover, the sell-offs could lead to reduced research and development spending, which could slow down the pace of innovation in the semiconductor industry.

Conclusion

Navitas Semiconductor’s recent sell-offs represent a significant development in the semiconductor industry. While the decline in the company’s stock price may present challenges for investors, it is essential to remember the long-term potential of Navitas Semiconductor and its technology. The company’s GaN-on-silicon power semiconductors have the potential to revolutionize various industries, from automotive to renewable energy. As investors and observers, we must remain focused on the bigger picture and the potential benefits of this technological innovation.

- Navitas Semiconductor experienced significant sell-offs, with its stock closing down 22.7% from the previous week.

- Factors contributing to the sell-offs include market trends and financial results.

- Navitas Semiconductor’s technology offers advantages over traditional silicon-based solutions.

- The sell-offs present opportunities and risks for individual investors.

- Navitas Semiconductor’s technology can contribute to energy efficiency and reduced carbon emissions.

- The sell-offs could deter investment in the semiconductor industry and slow down innovation.